Shares of Digi International were up about 4.8% in Tuesday’s pre-market session, after the provider of IoT [internet of things] connectivity products, services and solutions announced the acquisition of Haxiot for an undisclosed amount.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Notably, Haxiot provides low power, wide area, wireless technology and has an extensive LoRaWAN product portfolio.

Digi International (DGII) said that the acquisition would enhance its embedded systems portfolio and help It to expand its market reach with Haxiot’s LoRaWAN offerings. Digi added that Haxiot’s offerings along with Digi’s products will broaden the portfolio, thus benefiting customers. Haxiot would additionally bring industrial IoT capabilities and other value-added services.

Steve Ericson, the general manager of OEM Solutions for Digi International said, “Adding Haxiot’s LoRaWAN platform to our existing portfolio provides customers with a single-source for their embedded systems needs and the ability to get to market faster with the right technology for their applications.” (See Digi International stock analysis on TipRanks).

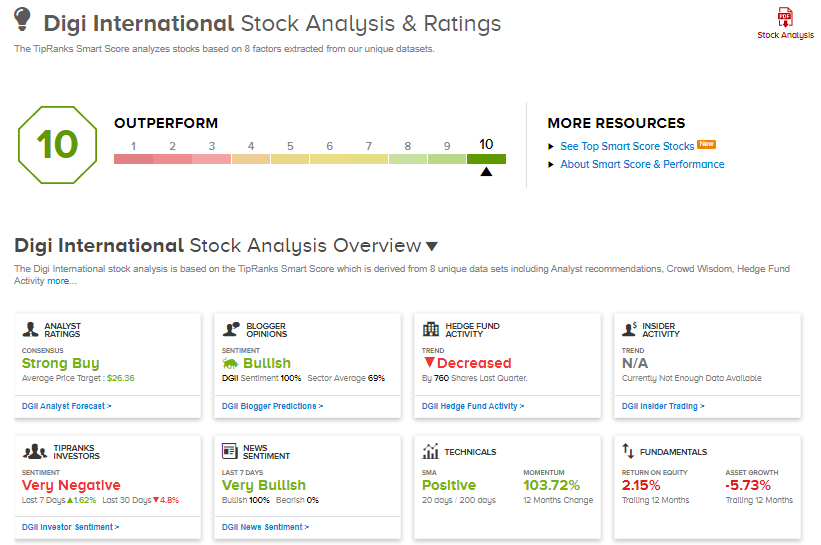

On March 9, Piper Sandler analyst Harsh Kumar initiated coverage on Digi International stock with a Buy rating and a price target of $29 (56.1% upside potential). The analyst thinks that the company is “undervalued and underappreciated” as he believes that the company’s internet of things solutions business and annual recurring revenue growth are not priced into the valuation multiple. Kumar added that he believes that current share price levels are an “attractive entry point.”

Overall, the Street has a bullish outlook on the stock with a Strong Buy consensus rating based on 6 Buys and 1 Hold. The average analyst price target of $26.36 implies upside potential of about 41.9% to current levels. Shares have rallied about 104% in one year.

Furthermore, DGII scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Canoo’s 4Q Loss Improves On Electric Vehicles Strength

Hartford Walks Away From Chubb’s Merger Offer

NV5 Global Buys Geodynamics For $42M, Boosts Deep-Water Geospatial Capacity