Last week, tech billionaire Tesla (TSLA) CEO Elon Musk brought up a surprise condition for completing the Twitter (TWTR) buyout deal. He demanded a trove of data from the social media company to independently assess the extent of fake accounts on the platform. The $44-billion deal would not move forward unless Twitter released the data.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Interestingly, Twitter has handed over the data that Musk had requested, but analyzing it to determine the number of fake accounts on the platform could pose a challenge for the billionaire.

According to a Wall Street Journal report, data scientists and social media specialists believe that Musk would have a difficult time proving that Twitter has more fake accounts than it has revealed.

Disagreements over Fake Accounts

While Twitter maintains that fewer than 5% of its accounts are fake, Musk thinks that more than 20% of the accounts may be phony. Among the challenges that Musk now faces is that he may incur substantial costs to analyze the massive data that Twitter has provided.

Additionally, Twitter would have strong ground to dispute Musk’s estimate of fake accounts if it turns out to be different from its own figures. The reason is that Twitter has a better understanding of its platform, and it also has unique ways to measure fake activities. Moreover, experts say there is no standard definition of a fake account, providing another ground for potential disagreement on the estimates.

Wall Street’s Take

With the pending Twitter buyout, analysts have a Hold consensus rating on the stock, which is based on one Buy and 24 Holds. Twitter’s average price target of $51.10 implies nearly 32% upside potential to current levels. Shares of the company are trading at a 28% discount to Musk’s $54.20 buyout offer price.

Bloggers’ Stance

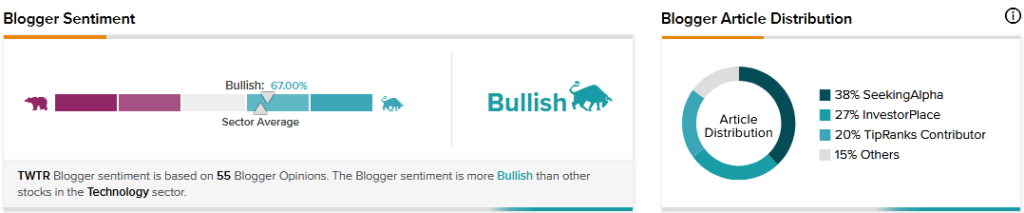

TipRanks data shows that financial bloggers are 67% Bullish on TWTR, compared to the sector average of 65%.

Key Takeaway

Musk has long appeared to be in the driver’s seat in the Twitter buyout deal, but Twitter has taken a step that could limit Musk’s options to abandon the deal or renegotiate it. Musk or Twitter would be on the hook for a $1 billion breakup fee if the deal falls apart.

Read full Disclosure