Oil tankers are seeing a substantial uptick in profits thanks to a confluence of strong oil demand growth, limited supply due to longer voyage distances, and an aging fleet. This has resulted in the share prices of tanker companies enjoying significant appreciation. A prime beneficiary of this trend is DHT Holdings (NYSE:DHT), whose stock has more than doubled in valuation over the past three years.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

DHT stands out from its peers thanks to its attractive combination of stout earnings growth, high levels of profitability, and a robust dividend yield. The stock is currently trading at reasonable valuations, making it a compelling candidate for growth and income investors.

Young Fleet of Supertankers

DHT Holdings is a global, independent crude oil tanker company that specializes in ‘very large crude carriers’ (VLCC). DHT operates through integrated management companies located in Monaco, Norway, Singapore, and India. It offers long-term charters, which helps to ensure a steady stream of fixed income.

The company exclusively owns a fleet of 24 VLCCs, which includes some of the largest crude tankers currently in operation, rated between 299,000 and 320,000 dry-weight tonnage (DWT). The majority of vessels were built in 2011 or later. This gives DHT a competitive advantage vis-a-vis the aging fleets across the industry. The company has also ordered four additional state-of-the-art eco-friendly tankers, due for delivery in 2026.

Recent geopolitical developments and changes in oil trade routes have resulted in an increased demand for long-trip tankers and a boost in the freight market, with DHT being a key beneficiary. Sanctions on Russian oil by Europe and the U.S., as well as subsequent shifts in trade routes related to the conflict around the Red Sea, have led to a demand for longer hire periods for tankers to transport oil around the world. This increasing demand, against a relatively stable supply of tankers, has driven up rental rates significantly.

DHT’s business is further bolstered by its strong position in East Asia, especially China, and the ongoing high demand for oil originating in the United States, Brazil, and Guyana. Predictions for the near-to-mid-range future suggest consistent high tanker utilization and rates, supported by strong oil demand, prolonged travel distances, and slow fleet growth.

Recent Financial Results

In its recent 4Q23 report, DHT posted adjusted net revenues of $94.5 million, below consensus estimates of $102.22 million. However, the earnings per share was roughly in line with expectations at $0.22.

Overall, 2023 was the second most profitable year in the company’s history. The net income for 2023 was $161.4 million, or $0.99 per diluted share. This is a significant increase from the net income of $62.0 million, or $0.37 per diluted share, recorded in 2022.

The company’s capital allocation policy of distributing 100% of net income led to its most recent dividend of $0.22 per common share. This represented a 15.7% rise from the prior payment, contributing to a healthy 8% plus yield to shareholders. This marks the 56th consecutive quarterly cash dividend paid by the company.

What is the Target Price for DHT Stock?

The company’s shares have been trending upward, climbing over 22% YTD, and are trading at the high end of the 52-week price range of $6.60-$11.96. The stock continues to demonstrate positive price momentum, trading above the 20-day (11.36) and 50-day (11.04) averages.

The stock appears fair-to-undervalued based on comparative metrics against its peers and its historical averages. For instance, a P/E of 11.9x is in line with the Energy sector average P/E of 11.4x, but below the company’s historical average P/E of 18.7x.

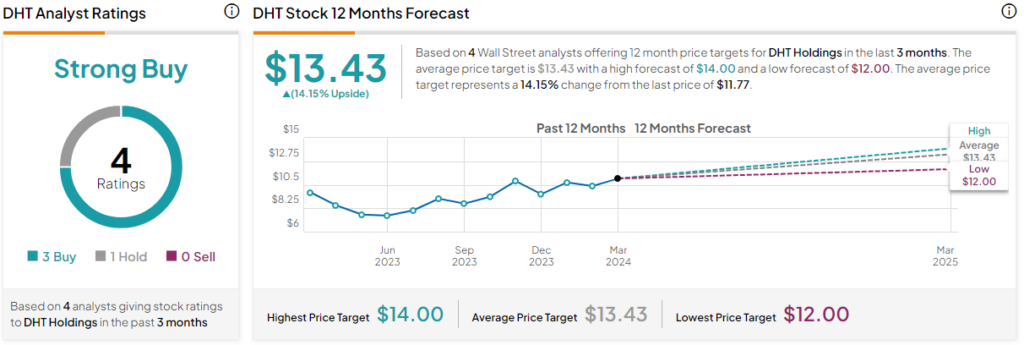

Analysts covering the company are mostly bullish on the stock. It is rated a Strong Buy based on the outlook and 12-month price targets assigned by four Wall Street analysts who have published coverage over the past three months. The average price target for DHT stock is $13.43, which represents a 14.15% upside from current levels.

Big Picture for DHT

The company is well-positioned to take advantage of a rising tide lifting all the boats in this market, especially with DHT’s relatively young VLCC fleet and its strong, competitive position in countries with high oil demand. The earnings momentum has translated into positive price movement for the stock, and there is no reason to suspect that the ride will end anytime soon. Furthermore, the company’s commitment to pass along 100% of net income supports the continuation of a robust dividend payout. DHT Holdings can serve as a compelling candidate for investors seeking income and growth at a reasonable price.