D.R. Horton (NYSE:DHI) posted better-than-expected results in the Fiscal third quarter. The company reported earnings of $4.10 per share in the Fiscal third quarter, up by 5% year-over-year, exceeding consensus estimates of $3.75 per share

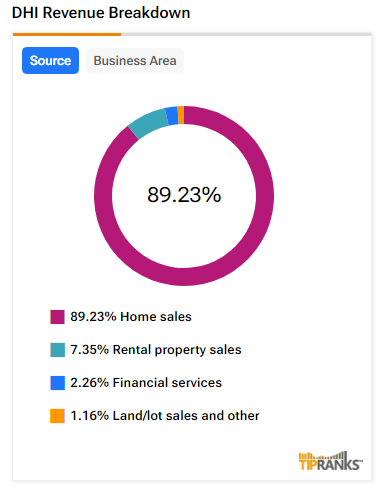

DHI’s Revenue Breakdown

The home construction company generated revenues of $10 billion in the third quarter, up 2% year-over-year. This beat analysts’ expectations of $9.6 billion. DHI’s homebuilding operations generate more than 85% of its revenues from the sale of completed homes.

In the third quarter, the company’s homebuilding business generated revenues of $9.2 billion, an increase of 6% year-over-year.

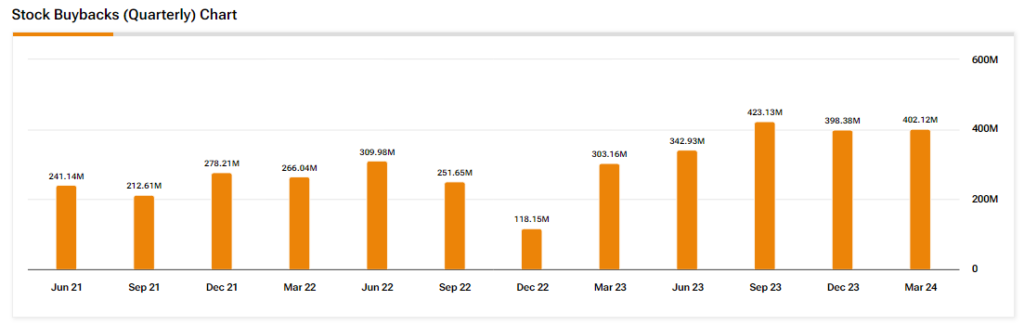

DHI’s Dividends and Stock Buyback

The company declared a quarterly cash dividend of $0.30 per common share, payable on August 8 to stockholders of record on August 1, 2024. During the third quarter, DHI repurchased 3 million shares worth $441.4 million. As of June 30, 2024, DHI had a remaining stock buyback authorization of $459.7 million.

In July, the company’s Board of Directors authorized the repurchase of up to $4 billion of its common stock. This will replace the previous stock buyback authorization and has no expiration date.

DHI’s FY24 Outlook

Looking forward, management now expects FY24 revenues to be in the range of $36.8 billion to $37.2 billion. For FY24, DHI has forecasted the sale of 90,000 to 90,500 homes. Share repurchases are likely to be worth $1.8 billion in FY24.

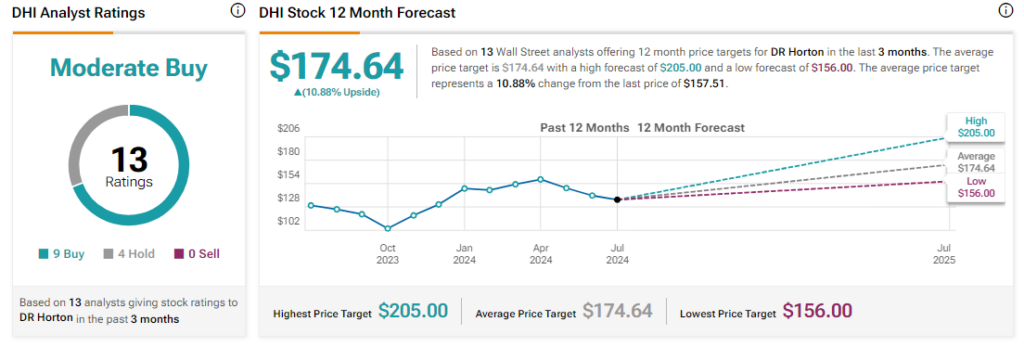

Is DHI a Good Investment?

Analysts remain cautiously optimistic about DHI stock, with a Moderate Buy consensus rating based on nine Buys and four Holds. Over the past year, DHI has increased by more than 20%, and the average DHI price target of $174.64 implies an upside potential of 10.8% from current levels. These analyst ratings are likely to change following DHI’s Q3 results today.