As we enter 2025, investors are keen to know what lies ahead for Advanced Micro Devices (AMD). Despite the company’s ambition to bridge the gap from Nvidia (NVDA) with the aid of its newest AI processors, it’s fair to say AMD faced a challenging 2024. Nevertheless, Wall Street analysts see a promising future for the semiconductor giant. This piece will explore AMD’s 2024 performance, its tempting valuation, and the analysts’ take on its 2025 prospects.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

If you wish to read more about AMD’s current standings, you should read our analyst, James Fox’s optimistic take on the company’s financials and valuation.

- Reflecting on 2024 Performance and the Last Quarter: 2024 was a mixed bag for AMD, with its share price declining by 11%. This was a tough pill to swallow for investors, especially when compared to Nvidia’s impressive 180% rise. However, AMD’s performance in the last quarter showed signs of resilience. The data center segment surged with a year-over-year growth of 122% and a quarter-over-quarter growth of 25%. This growth helped offset declines in other areas, showcasing AMD’s potential to bounce back.

- Tempting Valuation and 2025 Initiatives: One of the most compelling reasons to be bullish on AMD is its attractive valuation. The company’s forward PEG ratio of 0.87 is significantly lower than the sector median, indicating that the stock is undervalued relative to its expected earnings growth. Additionally, AMD’s initiatives for 2025, including the launch of AI-enabled processors and gaming hardware at CES 2025, position it well for future growth. The introduction of the Ryzen AI Max processor and updates to its gaming lineup is expected to drive significant revenue.

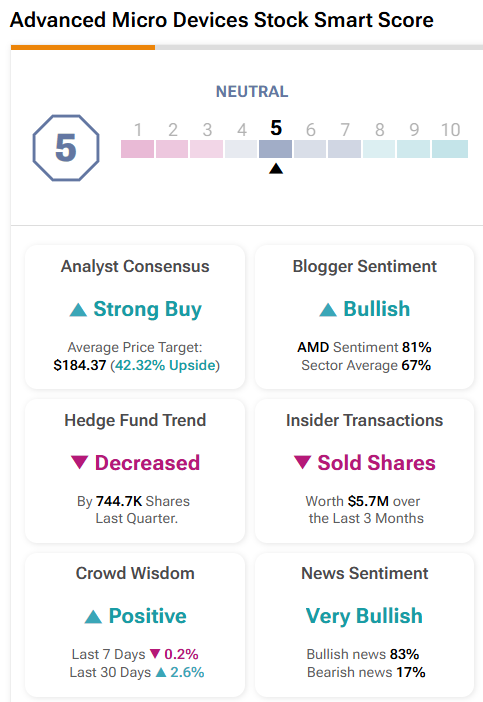

- Analyst Sentiments and TipRanks’ Smart Score: Wall Street analysts are optimistic about AMD’s future. Despite a testing year, with record revenues and increased operating margins failing to lift share prices, analysts still see potential due to the company’s strong fundamentals. The data center segment grew by triple digits last quarter, and AMD is destined to benefit from the global AI build-out. Northland’s Gus Richard views AMD as a top pick for 2025, citing its potential to gain market share in AI GPUs, server CPUs, and PC clients. Another factor to consider is TipRanks’ Smart Score for AMD, which has a solid 5, indicating a neutral stance but with a strong buy consensus among analysts. This suggests that while there may be short-term volatility, the long-term outlook remains positive.

What’s the Upside for AMD?

Turning to Wall Street, AMD is considered a Strong Buy. The average price target for AMD stock is $184.37, suggesting a 42.32% upside potential.

Prospects for 2025

While AMD faced significant challenges in 2024, including a decline in share price and struggles to emerge from Nvidia’s shadow, the outlook for 2025 appears promising. With strong performance in the data center segment, an attractive valuation, and positive analysts’ sentiments, AMD is well-positioned for growth. Analysts are optimistic about AMD’s potential to increase its market share in 2025, suggesting that despite short-term volatility, the long-term prospects for AMD remain bright.