Denny’s Corp. reported fourth-quarter results, which fell short of the Street’s estimates, as the restaurant chain operator grappled with the negative impact of the COVID-19 pandemic. Denny’s stock was down 1.1% in Tuesday’s extended trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Denny’s (DENN) reported fourth quarter revenues of $80.1 million that declined 29.6% year-over-year and missed analysts’ expectations of about $81.3 million. Its franchise and license revenue of $47.2 million decreased 27.4% year-over-year, while its restaurant sales of $32.9 million fell 32.6% year-over-year. The company’s domestic system-wide same-store sales slumped 32.9% in 4Q.

The company said, “These changes were primarily due to the impact of the COVID-19 pandemic on sales and fewer equivalent units, partially offset by an additional operating week.” (See Denny’s stock analysis on TipRanks)

Denny’s reported a 4Q adjusted loss of $0.05 per share, compared to the year-ago period’s earnings of $0.23 per share. Analysts were looking for a loss of $0.01 per share.

Following the 4Q results, Oppenheimer analyst Michael Tamas reiterated a Buy rating on Denny’s stock with a price target of $19 (15.6% upside potential).

Tamas said, “DENN appears uniquely positioned for an outsized sales recovery as dining restrictions ease. A reopening environment would allow additional units to reinstall late-night (e.g.,+8-10% to current trends) and reverse the negative impact of California’s off-premise only mandate (25% of units).”

He added, “We also see an attractive setup for capital returns to shareholders in late-’21 and for accelerating unit growth in ’22 (and beyond).”

Meanwhile, the rest of the Street has a cautiously optimistic outlook on the stock, with a Moderate Buy consensus rating based on 3 Buys and 4 Holds. The average analyst price target of $16.14 implies downside potential of 1.8% to current levels. Shares are down about 18.5% over the past year.

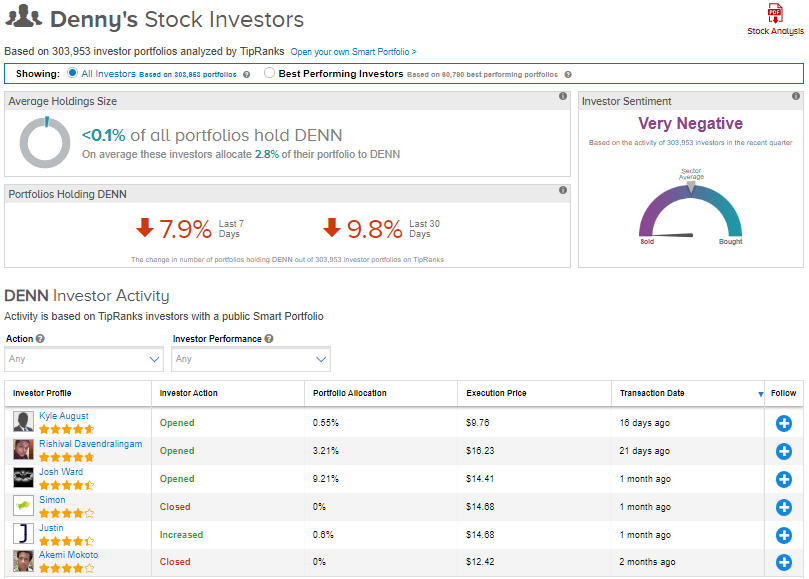

Additionally, the TipRanks’ stock investors tool shows that investors currently have a Very Negative stance on DENN.

Related News:

Palantir Drops 8.6% After Surprise Quarterly Loss

Rexnord’s 3Q Profit Tops Analysts’ Estimates; Shares Rise 4%

Jack Henry Shores Up Quarterly Dividend By 7%; Street Sees 19% Upside