Delta Air Lines plans to raise $6.5 billion in debt backed by its SkyMiles loyalty program as part of its efforts to bolster its liquidity in the current crisis. DAL stock rose 3.5% on September 14 in reaction to the announcement.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Delta Air Lines (DAL) and its newly formed subsidiary SkyMiles IP Ltd. intend to raise $6.5 billion through a private offering of senior secured notes and a senior secured term loan facility. SkyMiles will lend the net proceeds of the bond offering and term loan to Delta, after a portion of the proceeds is deposited in a reserve account.

The Atlanta-based airlines is eligible for a $4.6 billion federal loan under the CARES (Coronavirus Aid, Relief, and Economic Security) Act, but said that it does not intend to pursue this loan.

Delta’s peers United Airlines and American Airlines have also announced plans to use their loyalty programs as collateral to raise loans to weather these challenging times triggered by the pandemic.

Rising COVID-19 cases continue to hurt airline traffic. On Monday, Delta also disclosed that its system capacity is expected to be down 60% Y/Y in the September quarter, with international capacity down 80% and domestic capacity down about 50%. As a result of reduced demand forecast and lower capacity in the September quarter and beyond, the carrier has parked about 40% of its mainline fleet, including the permanent retirement of certain aircraft.

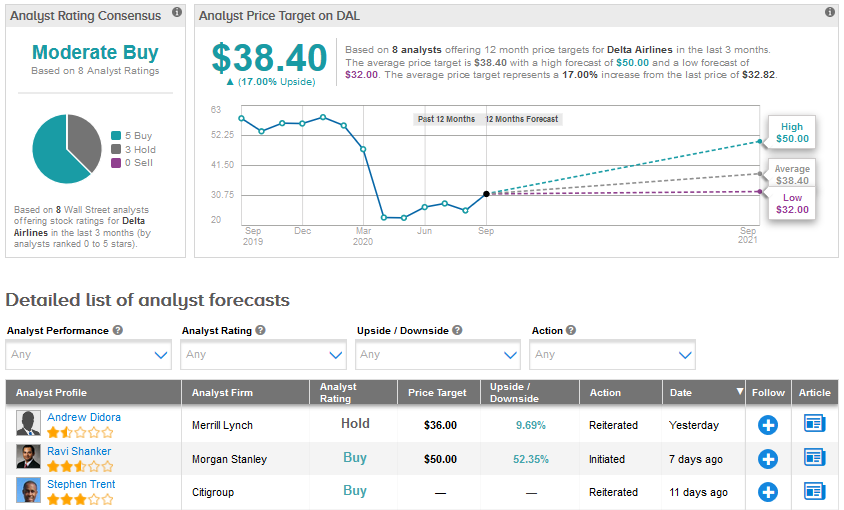

Following the update, Merrill Lynch analyst Andrew Didora raised his price target for Delta Air Lines stock to $36 from $31 but maintained a Hold rating. The analyst said that he views airline stocks as options on a recovery from the COVID-19 crisis, and prefers those with longer duration in the form of liquidity runways.

Didora said that Southwest and Alaska Air, which he rates Buy, have liquidity into 2023, while Sell-rated American and Hawaiian have the shortest runways, until August 2021. (See DAL stock analysis on TipRanks)

Year-to-date, DAL stock has declined 44% but has an upside potential of 17% in the coming months as reflected by the average analyst price target of $38.40. The Street has a Moderate Buy consensus for Delta based on 5 Buys, 3 Holds and no Sell ratings.

Related News:

Boeing’s 737 MAX Jets To Face Joint Training Review – Report

United Airlines Lowers 3Q Revenue Forecast As Travel Demand Fails To Return

JetBlue Adds 24 New Routes In A Bid To Capture Traffic