Delta Air Lines Inc. (DAL) on Thursday announced a decision to retire the Boeing (BA) 777 aircraft and remove it from its service by the end of this year, as the embattled U.S. airline seeks to lower costs amid global travel restrictions which have brought passenger traffic to an almost complete standstill.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

In addition, the ailing airline will also accelerate the retirement of its MD 90 aircraft, which will exit the fleet in June. As a result of the steps, Delta expects to record non-cash aggregate impairment charges of between $1.4 billion to $1.7 billion, before tax.

“These decisions are intended to better align our network with lower passenger demand stemming from the COVID-19 pandemic, streamline and modernize our fleet, and generate cost savings,” Delta said in a SEC filing. “We plan to continue to consider further opportunities for early aircraft retirements in an effort to modernize and simplify our fleet in the future.”

U.S. airlines from American Airlines Group Inc (AAL) to Delta Air Lines are collectively burning more than $10 billion in cash a month, according to industry trade group Airlines for America. The steep plunge in passenger traffic fueled by the coronavirus-related travel restrictions has forced many global airlines to streamline operations and cut costs, as well as raise debt to boost liquidity.

“Our principal financial goal for 2020 is to reduce our cash burn to zero by the end of the year, which will mean, for the next two to three years, a smaller network, fleet and operation in response to substantially reduced customer demand,” Delta CEO Ed Bastian said in a memo to employees. “Our A330s and A350-900s, which are more fuel-efficient and cost-effective, will perform long-haul flying as international demand returns.”

Bastian disclosed that Delta, which is burning about $50 million in cash a day, has returned more than $1.2 billion in refunds to its customers since the start of the coronavirus pandemic, including $160 million so far this month.

Shares in Delta depreciated 1.8% to $19.08 in early afternoon trading, extending this year’s plunge to 68%.

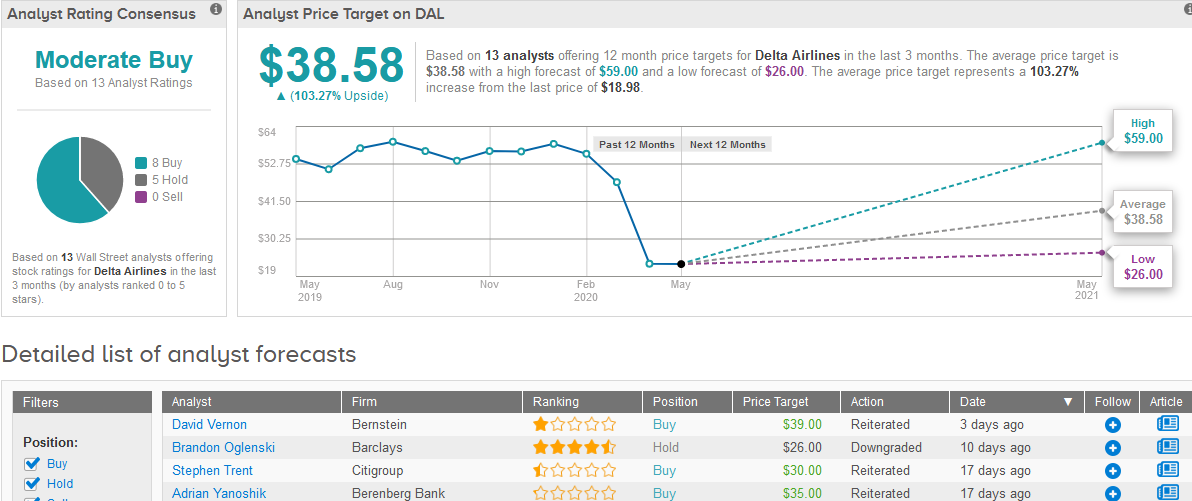

Bernstein analyst David Vernon this week slashed the airline’s price target to $39 from $64 while maintaining a Buy rating.

Turning now to the rest of Wall Street analysts the outlook is divided between 8 Buys and 5 Holds adding up to a Moderate Buy consensus. The $38.58 average price target implies investors may come home with a whopping return of 103%, should the target be met in the next 12 months. (See Delta stock analysis on TipRanks).

Related News:

Boeing Gets No Orders in April, Customers Cancel 737 MAX Jets

Colombian Carrier Avianca Files for Bankruptcy Protection Due to Coronavirus Woes

Qantas Said to Halt Plane Deliveries From Boeing, Airbus Amid Travel Freeze