Shares of Delta Air Lines (NYSE:DAL) are trending nearly 5% higher today after the company reaffirmed its financial outlook on the sidelines of the Morgan Stanley Global Consumer & Retail Conference.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

For Fiscal Year 2023, Delta expects revenue growth of about 20%. EPS for the year is anticipated to be in the range of $6 to $6.25. For the fourth quarter, the company expects revenue growth to hover between 9% and 12%. EPS for the quarter is seen landing between $1.05 and $1.30.

Earlier, Delta had anticipated about 6.2 million to 6.4 million customers over the Thanksgiving period. The reaffirmed outlook indicates travel trends remained robust, as expected during this period.

Delta is scheduled to report fourth-quarter results on January 11. Analysts expect the company to generate an EPS of $1.15 on revenue of $13.57 billion for the quarter. In the comparable year-ago period, Delta’s EPS of $1.48 had comfortably cruised past expectations by $0.16.

How High Will Delta Stock Go?

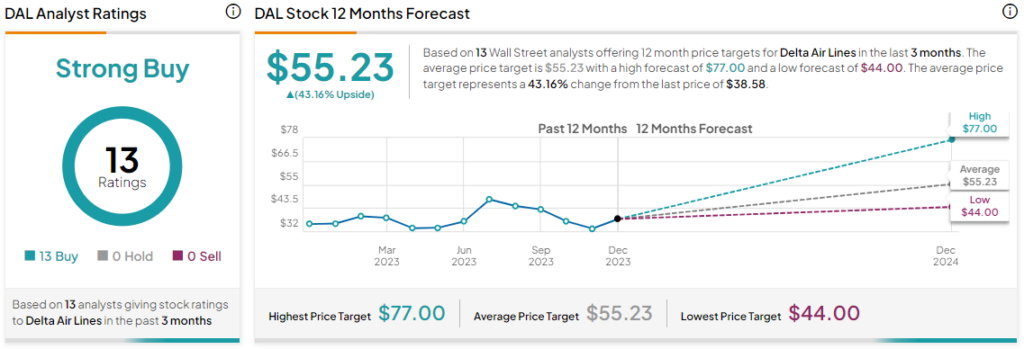

Overall, the Street has a Strong Buy consensus rating on Delta Air Lines. After a nearly 18% jump in its share price over the past month, the average DAL price target of $55.23 implies a further 43.2% potential upside in the stock.

Read full Disclosure