Delta Air Lines (DAL) is set to release its third quarter 2024 financials on October 10. Wall Street analysts anticipate a decline in both revenue and earnings for Q3, indicating potential weakness in DAL’s near-term performance. They expect the company to report earnings of $1.54 per share, representing a 25% decrease year-over-year. Additionally, revenues are expected to fall by 5.5% from the year-ago quarter to $14.64 billion, according to data from TipRanks.

As we approach Q3, it’s crucial to note that DAL has faced numerous challenges in recent months. A significant issue was the IT failure caused by CrowdStrike (CRWD), which led to major operational disruptions over five consecutive days, causing reputational damage. The company has indicated that this outage is likely to impact its third-quarter results.

Other Factors to Consider Ahead of Q3

In addition to the global IT outage in July, Delta is also dealing with domestic overcapacity challenges, which is pressuring revenue per available seat mile (RASM). The airline has reported a 2% drop in RASM and has adjusted its sales and earnings outlook for Q3 of this year.

Despite these challenges, according to TipRanks’ Bulls Say, Bears Say tool, optimistic analysts highlight that Delta’s corporate travel has surpassed pre-COVID levels. The company’s improved operational performance and rising Net Promoter Scores (NPS) enhance confidence in Delta’s prospects. Additionally, analysts note that the airline is experiencing positive unit revenue growth in both domestic and transatlantic markets.

Options Traders Anticipate a 6.45% Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 6.45% move in either direction.

Is Delta Stock a Good Buy Right Now?

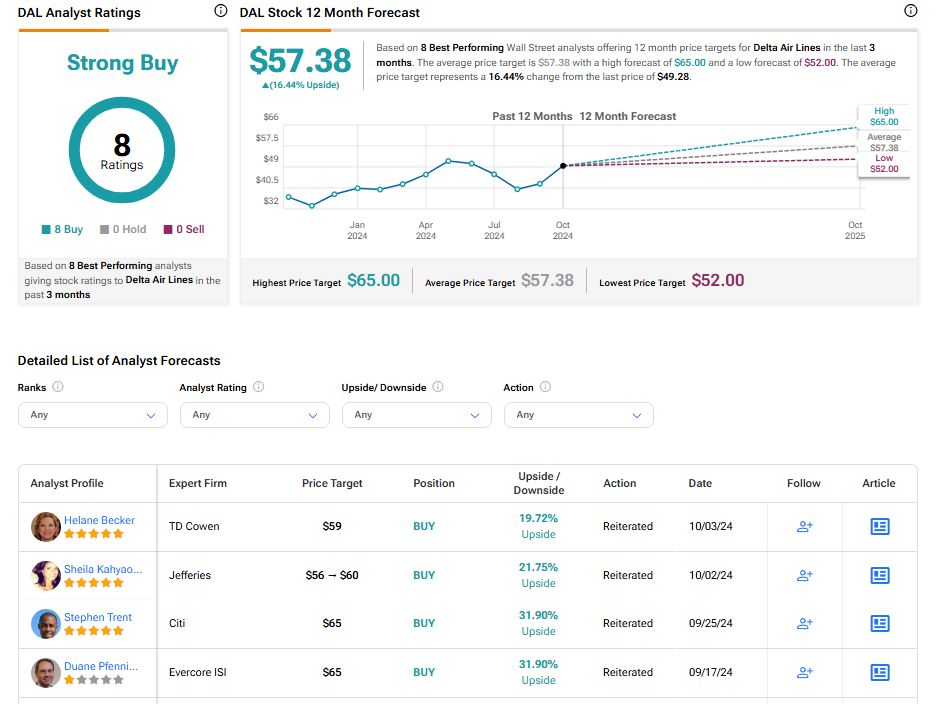

Turning to Wall Street, Delta Air Lines stock has a Strong Buy consensus rating based on eight unanimous buys assigned in the last three months. At $57.38, the average DAL price target implies 16.44% upside potential. Shares of the company have gained 6.69% in the past three months.