Dell (DELL) has reached an agreement to sell Boomi, its cloud-based integration platform as a service (iPaaS). Francisco Partners and TPG Capital have agreed to pay $4 billion in cash to acquire the unit, which has flourished since Dell acquired it in 2010.

Dell is offloading Boomi, having grown it to a customer base of over 15,000 worldwide. The sell-off is expected to position Boomi for its next phase of growth as Dell focuses on modernizing its core infrastructure and PC businesses.

Boomi has grown to become a pioneer in fueling intelligent data use. Its cloud solutions make it easy for organizations to connect application processes and people across various locations and devices.

TPG Capital partner, Nehal Raj, stated, “Boomi’s cloud-native platform enables enterprises to streamline business processes and is essential for driving digital transformation. TPG has a long history of partnering with corporate leaders like Dell Technologies to carve out and grow dynamic technology businesses. We look forward to working with the teams at Boomi and Francisco Partners to accelerate the company’s growth as an independent entity.” (See Dell stock analysis on TipRanks)

Dell has been on a divestment spree in recent years as it looks to increase its focus on the infrastructure and PC business. It has already confirmed plans to spin-off its 81% stake in VMware (VMW). Raymond James analyst Simon Leopold expects the VMware spin-off to unlock significant value.

“The action does not come as a complete shock, but the timing surprised us. We believe the transaction unlocks value and enables debt reduction, and the after-market trading of Dells’s shares (up ~8%) suggests investors like the deal,” Leopold wrote in a research note to investors.

Leopold has maintained a Buy rating on the stock and increased the share price target to $113 from $92, implying 15.57% upside potential to current levels.

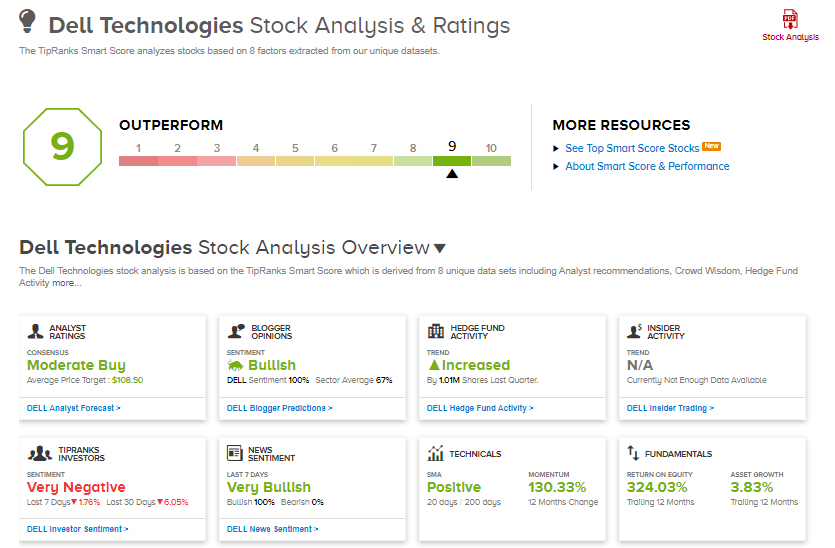

Consensus among analysts is a Moderate Buy based on 8 Buy and 3 Hold ratings. The average analyst price target of $108.50 implies approximately 11% upside potential to current levels.

DELL scores 9 out of 10 on TipRanks’ Smart Score rating system, implying it is well-positioned to outperform market expectations.

Related News:

Comcast Delivers Double-Digit Growth In 1Q

Woven Acquisition To Help Slack Rival Microsoft And Google

General Motors To Invest $1B To Produce Electric Cars In Mexico