Dell Technologies (NYSE: DELL) slipped in trading on Thursday even as the information technology company updated its financial framework for the long term. The company raised its share buyback to $5 billion and aims to up its quarterly dividend by 10% or more every year through FY28.

The company aims to grow its revenues in the range of 3% to 4% annually, with earnings per share growth of 8%. The firm expects a net income to adjusted free cash flow conversion of 100% or more and expects to return over 80% of adjusted free cash flow to shareholders through a combination of stock buybacks and dividends.

Michael Dell, Chairman and CEO of Dell Technologies, expressed confidence in their position to provide sustained value through technology advancements, including workplace solutions, multi-cloud, edge intelligence, AI, and GenAI.

Is DELL a Buy or Sell Share?

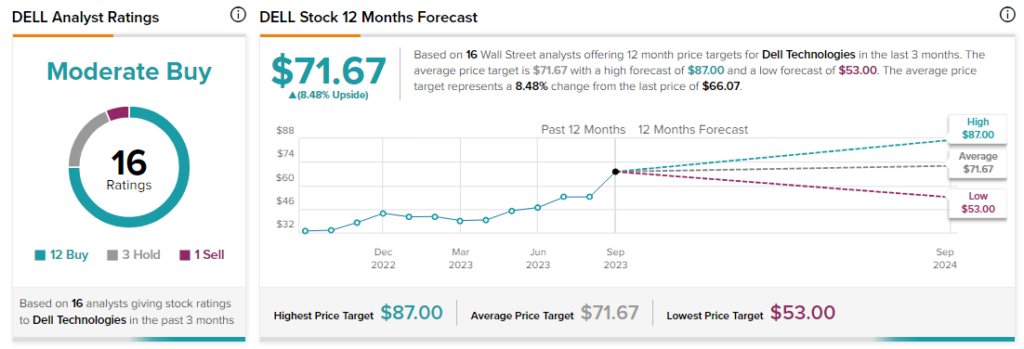

Analysts remain cautiously optimistic about DELL stock with a Moderate Buy consensus rating based on 12 Buys, three Holds, and one Sell.

Questions or Comments about the article? Write to editor@tipranks.com