Agriculture and equipment manufacturer Deere is planning to expand further in Australia and New Zealand based on a Sept. 18 Bloomberg report.

Luke Chandler, Deere’s (DE) chief economist, who is now assuming the role of managing director for Deere’s operations in Australia and New Zealand, said that he will target growth in construction and forestry, including road building and government infrastructure projects. The company will also bolster its precision agriculture business, turf and some mining operations.

In Australia, Deere recently released new software updates to the John Deere Operations Center and its MyOperations App to ‘help users further unlock the power of precision agriculture’.

The company has a strong presence in the agriculture business in the Australian and New Zealand markets. However, rival Caterpillar (CAT) is stronger in the mining and construction space.

“John Deere’s construction business is incredibly strong in North America, but we see a real opportunity given the sophistication of the clients and customers there,” said Chandler in an interview with Bloomberg.

In the tractor sector, Deere will focus on developing precision agriculture tools, many of which help farmers cut costs. “Around 60 per cent to 65 per cent of agriculture production is exported, so Australian and New Zealand farmers need to be extremely competitive in the world market” stated Chandler. He also noted that these nations don’t enjoy subsidies and safety nets available elsewhere in the world, including the US and European Union.

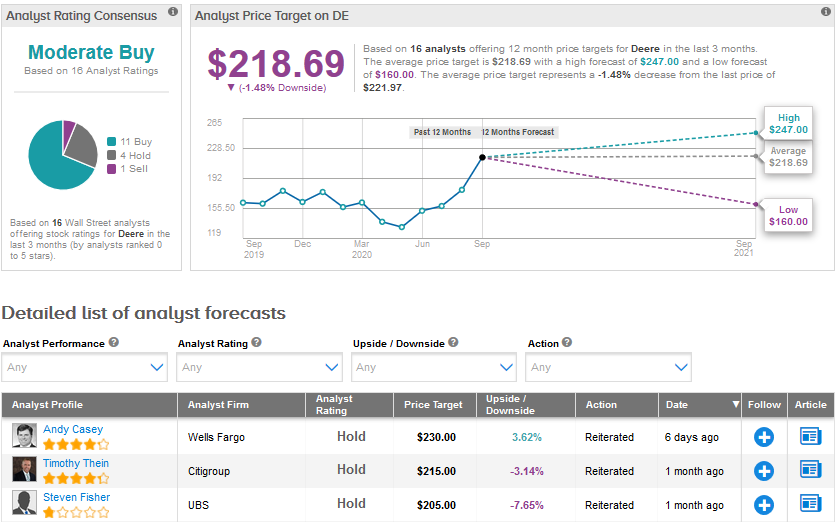

Meanwhile, Wells Fargo analyst Andrew Casey increased the price target for Deere to $230 from $220 on Sept. 15 but maintained a Hold rating. The analyst noted that the USDA (United States Department of Agriculture) crop progress report suggests the crop remains in decent shape and is also developing quicker than usual. However, crop rated in good to excellent condition decreased for corn and soybeans, which were down 100bps (basis points) and 200bps, respectively, from the previous week.

Casey views the negative revisions to crop condition as a modest medium-term positive for farm equipment stocks. (See DE stock analysis on TipRanks)

Deere stock has advanced 28% year-to-date. However, the average analyst price target of $218.69 indicates a possible downside of 1.5% in the months ahead. The Street is cautiously optimistic about Deere and has a Moderate Buy consensus based on 11 Buys, 4 Holds and 1 Sell rating.

Related News:

Boeing Gets Two Orders For 737-800BCF Freighter Jets

Smart Sand Inks $2M Deal For Eagle’s Oil & Gas Unit; Analyst Bullish

Rolls-Royce Seeks To Raise $2.5B, Including From Singapore’s GIC- Report

Questions or Comments about the article? Write to editor@tipranks.com