Deere & Company (NYSE: DE), a manufacturer of agriculture, construction, forestry, and turf care equipment, has inked a deal to acquire a majority ownership stake in Austria-based Kreisel Electric, Inc. The financial terms of the deal have been kept under wraps.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Kreisel produces innovative battery technology for e-mobility and stationary systems. Additionally, the company has introduced a charging infrastructure platform (CHIMERO) that utilizes this patented battery technology. The company serves multiple end markets globally, including commercial vehicles, off-highway vehicles, marine, e-motorsports, and other high-performance applications.

Benefits of the Acquisition

As demand for batteries as a sole- or hybrid-propulsion system for off-highway vehicles rises, Deere’s products, including, turf equipment, compact utility tractors, small tractors, compact construction, and some road-building equipment could primarily be battery-operated.

Therefore, through this acquisition, which enhances Deere’s electrification and sustainability goals, the company will be able to efficiently design vehicles and powertrains, incorporating superior immersion-cooled, high-density battery technology with optimal integration. Additionally, Kreisel’s battery-buffered charging technology will aid Deere in building infrastructure to support global customers.

Terms of the Agreement

Per the terms of the deal, Kreisel will retain its employees, brand name, and trademark, and continue to operate from Austria.

The transaction, which is likely to close in around 60 days, is pending final regulatory approval in Austria. (See Deere stock price charts)

Official Comments

SVP of John Deere Power Systems, Pierre Guyot, said, “Kreisel’s battery technology can be applied across the broad portfolio of Deere products, and Kreisel’s in-market experience will benefit Deere as we ramp up our battery-electric vehicle portfolio. Deere will provide the expertise, global footprint, and funding to enable Kreisel to continue its fast growth in core markets.”

“Furthermore, building an electrified portfolio is key to John Deere’s sustainability goal of pursuing new technologies that reduce the environmental impact of new products and work toward zero emissions propulsion systems on equipment, while increasing our customers’ efficiency and productivity,” Guyot added.

Analysts Recommendation

Following the acquisition, Robert W. Baird analyst Mircea Dobre maintained a Buy rating and a price target of $425 (21.93% upside potential) on the stock.

According to Baird, the recent acquisition enhances the company’s electrification capabilities and aids it in moving towards a fully electric, autonomous fleet.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 10 Buys, 3 Holds, and 1 Sell. The average Deere price target of $425.08 implies 22% upside potential. Shares have gained 33% over the past year.

Bloggers Weigh In

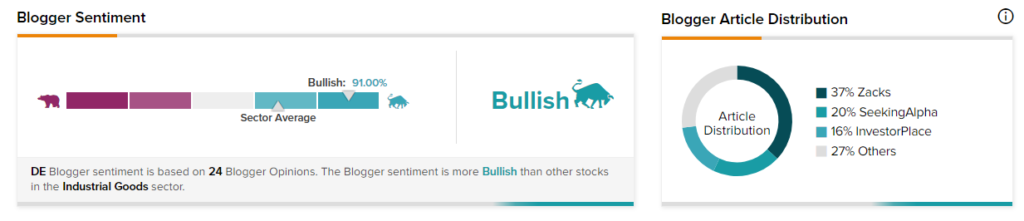

TipRanks data shows that financial blogger opinions are 91% Bullish on DE, compared to a sector average of 68%.

Related News:

Tesla CEO Elon Musk Confirms Acceptance of Doge for Merchandise Purchases – Report

Peloton Strikes Back with New Commercial – Report

EQT Corporation Unveils Capital Deployment Plan; Shares Gain