Shares of shoemaker Decker’s Outdoor (DECK), known for its popular Hoka runners and Ugg boots, are to begin trading on September 17 on a six-for-one split-adjusted basis.

The split is the second in the company’s 51-year history and comes after the stock has risen 78% in the past 12 months. Following the six-for-one split, DECK stock will begin trading at $156.23 based on the closing share price today (September 16).

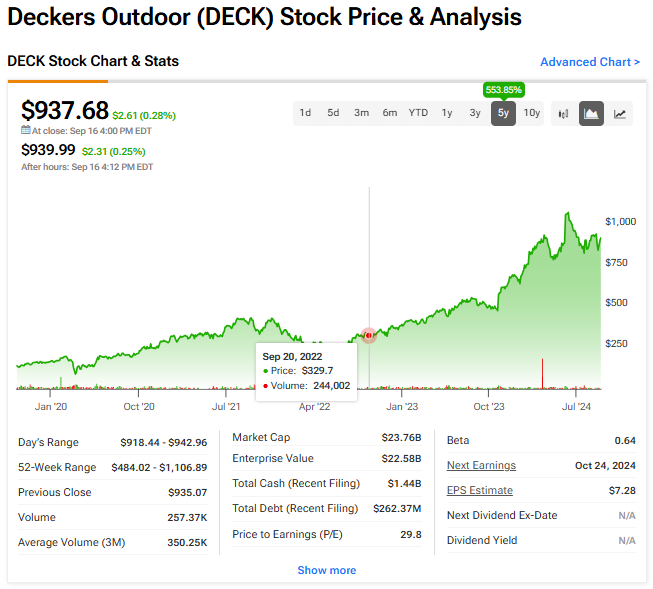

Shareholders approved the latest stock split at the company’s recently concluded annual meeting. Deckers previously split its stock on a three-for-one basis in 2010. Over the past five years, the share price has risen more than 550%, driven by strong sales of its footwear products that also include Teva sandals.

Strong Earnings Growth at Deckers Outdoor

At the end of July, Deckers Outdoor reported the latest in a string of financial results that beat Wall Street forecasts on the top and bottom lines. For what was the company’s fiscal first quarter, Goleta, California-based Deckers Outdoor reported earnings per share (EPS) of $4.52, which topped consensus expectations of $3.46. The profit was up 87% from a year earlier. Revenue totaled $825 million, ahead of Wall Street’s consensus estimate of $805 million. Sales rose 22% year-over-year.

The company also reported that its gross margin during the quarter rose to 56.9% from 51.3%. The quarterly results sent DECK stock up 10% in a single trading day and reinforced Wall Street’s bullish view of the company. Management attributed the strong results to sales of its Hoka running shoes, which have become extremely popular, followed by its Ugg footwear that is experiencing a resurgence on social media and among American consumers.

Looking ahead, Deckers Outdoor said that it continues to expect revenue in the current fiscal year to rise 10% and reach $4.70 billion. The company raised its full fiscal year earnings forecast to $29.75 to $30.65 per share. That’s up from a previous estimate of $29.50 to $30 a share. In addition to the stock split and strong financial results, Deckers Outdoor got a new CEO this summer. Company insider and former Chief Commercial Officer (COO) Stefano Caroti was elevated to the CEO role after the previous top executive, Dave Powers, retired. Caroti also serves on the company’s board of directors.

Is DECK Stock a Buy or Sell?

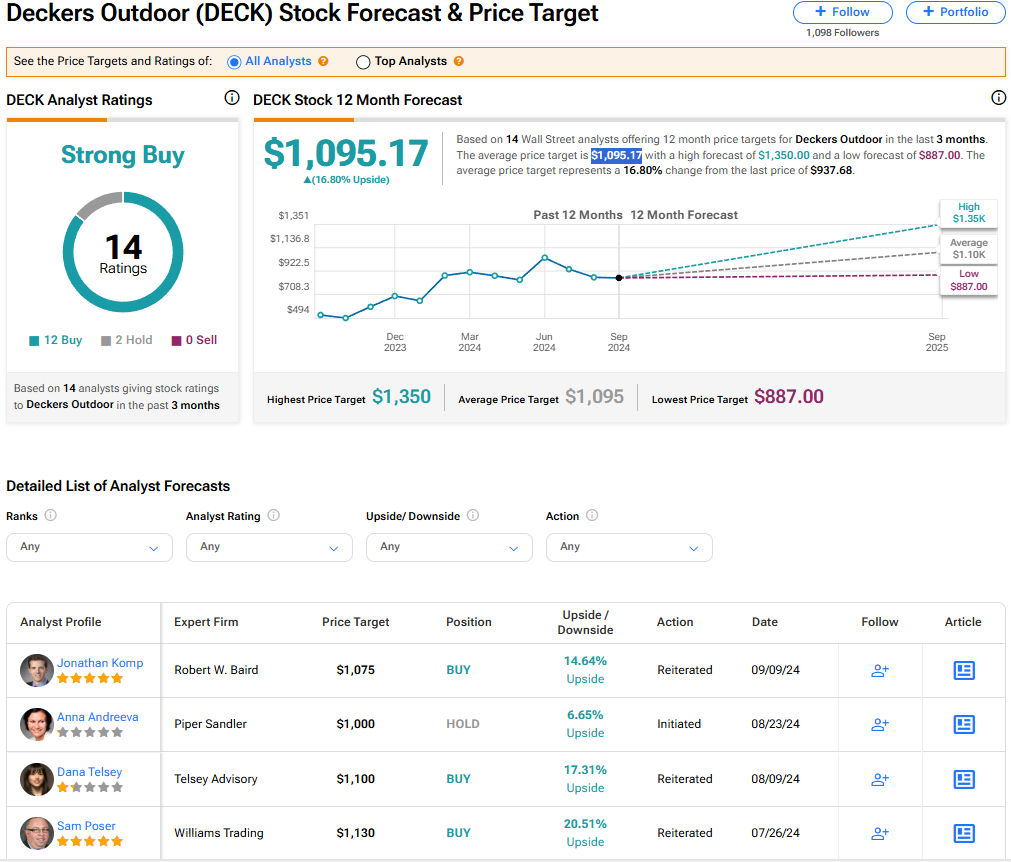

The stock of Deckers Outdoor currently has a consensus rating of Strong Buy among 14 Wall Street analysts who cover the company. There are 12 Buy ratings, and two Hold ratings on the stock. There are no Sell ratings. Furthermore, the average price target on DECK stock of $1,095.17 implies 16.8% upside potential from where the shares currently trade. (Note that current price targets are based on the pre-split stock price).

Read more analyst ratings on Deckers Outdoor stock

Conclusion

While it is true that stock splits don’t change the underlying fundamentals or valuation of a security, they can make the shares more affordable to purchase, particularly for retail investors. With Deckers Outdoor’s stock trading at more than $900 a share, the split will likely put the security more within reach for many investors who want to take a position in the fast-growing company. As such, DECK stock may experience a bounce in the days immediately after the six-for-one stock split is executed.

Questions or Comments about the article? Write to editor@tipranks.com