Shale oil and natural gas company Chesapeake Energy Corporation (CHK) is planning to advance a $25 million incentive compensation package to ensure executives remain motivated even as it is reportedly gearing up to file for bankruptcy protection to restructure its debt.

The total of $25 million will be paid to 21 executives, the company said in a SEC filing. The decision comes as Chesapeake has been grappling with the financial fallout of the oil and gas prices collapse, as the economic downturn tied to the coronavirus impact curtails energy demand. As a result, the energy company has reportedly been in talks to prepare for bankruptcy financing.

“The Board and Compensation Committee, with the advice of their independent compensation consultant and legal advisors, determined that the historic compensation structure and performance metrics would not be effective in motivating and incentivizing the company’s workforce,” Chesapeake said in the filing.

Executive compensation, including for CEO Robert Lawler, is 50% based on continued employment for a period of up to 12 months and 50% based on achieving certain specified incentive metrics. As a condition to receive the compensation, executive officers and vice presidents will have to waive participation in the company’s 2020 annual bonus plan as well as their rights to all 2020 equity compensation awards.

In addition, Chesapeake said that in an effort to maintain the continuity of its workforce the annual incentive plan for all other employees will be converted into a program that would pay “cash retention payments earned on a quarterly basis over a 12-month period”. The payments are also conditional on continued employment.

Last month, the battled energy company suspended dividend payments after completing a reverse stock split aimed at boosting its share price to stave off a delisting that could have triggered calls for some immediate debt repayment. The move was initiated after Chesapeake shares plunged more than 80% this year to as low as 16 cents.

Shares in Chesapeake were down 3.5% to $14.18 in pre-market U.S. trading.

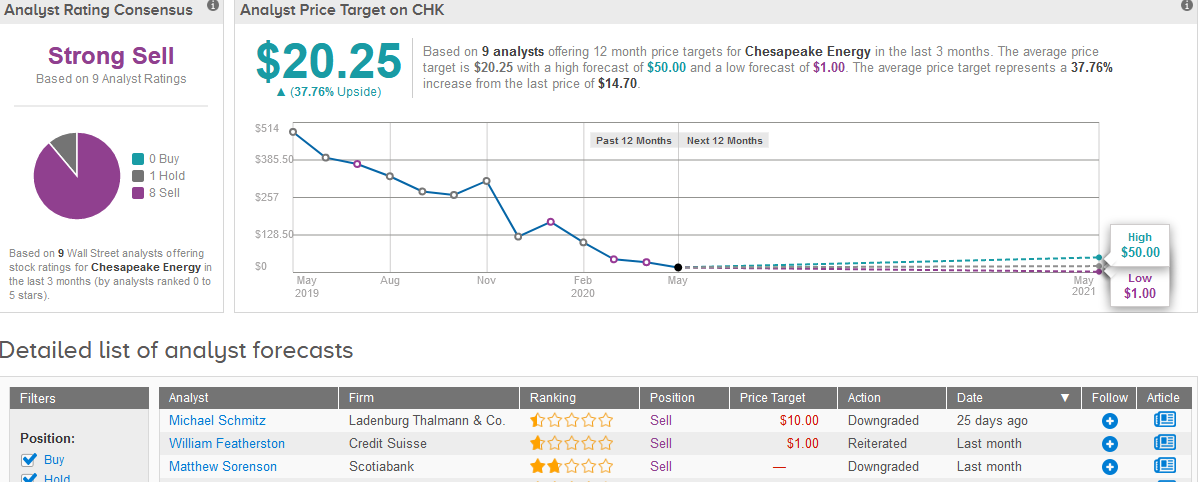

Last month Michael Schmitz analyst at Ladenburg Thalman & Co. cut the company’s stock to Sell from Hold with a price target of $10.

“We believe uncertainty over the duration and magnitude of the negative impact on the financial and commodity markets from the coronavirus is likely to continue to significantly weigh on its stock price near-term given its high debt level,” Schmitz wrote in a note to investors.

Turning now to the rest of Wall Street analysts a bearish sentiment reigns with 8 saying Sell the stock and 1 says Hold adding up to a Strong Sell consensus rating. However, the $20.25 average price target implies 38% upside potential in the shares in the coming 12 months. (See Chesapeake stock analysis on TipRanks).

Related News:

AMC Pops 11% Amid Potential Acquisition Talks by Amazon

ON Semiconductor Quarterly Earnings Miss Amid Virus Pandemic, Sees Orders Coming Back

Seres Therapeutics Reports Weak Earnings, But Significant Upside Lies Ahead