Shale oil and natural gas company Chesapeake Energy Corporation (CHK) on Sunday filed for bankruptcy protection proceedings to eliminate its $7 billion debt load and strengthen its balance sheet.

The U.S. oil and gas producer said it filed for Chapter 11 protection in the U.S. Bankruptcy Court for the Southern District of Texas to facilitate a “comprehensive balance sheet restructuring”.

Chesapeake has been grappling with the financial fallout of the oil and gas prices collapse, as the economic downturn tied to the coronavirus impact curtails energy demand.

As part of a restructuring agreement, the company has secured $925 million in debtor-in-possession financing from certain lenders under its revolving credit facility, which will be available upon court approval.

The financing package will provide Chesapeake with the capital necessary to fund its operations during the court-supervised Chapter 11 reorganization proceedings, it said. In addition, certain lenders under the company’s revolving credit facility have also agreed to the principal terms of a $2.5 billion exit financing, consisting of a new $1.75 billion revolving credit facility and a new $750 million term loan.

Furthermore, Chesapeake said it has the support of its term loan lenders and secured note holders to backstop a $600 million rights offering upon exiting the Chapter 11 process.

“Despite having removed over $20 billion of leverage and financial commitments, we believe this restructuring is necessary for the long-term success and value creation of the business,” Chesapeake’s President and CEO Doug Lawler said. “By eliminating $7 billion of debt we are positioning Chesapeake to capitalize on our diverse operating platform and proven track record of improving capital and operating efficiencies and technical excellence.”

“With these demonstrated strengths, and the benefit of an appropriately sized capital structure, Chesapeake will be uniquely positioned to emerge from the Chapter 11 process as a stronger and more competitive enterprise,” Lawler added.

The stock dropped 7.3% to $11.85 at the close on Friday. Shares have plunged a whopping 93% year-to-date, with the oil and gas giant reporting a “going concern” warning in its May quarterly financial filing.

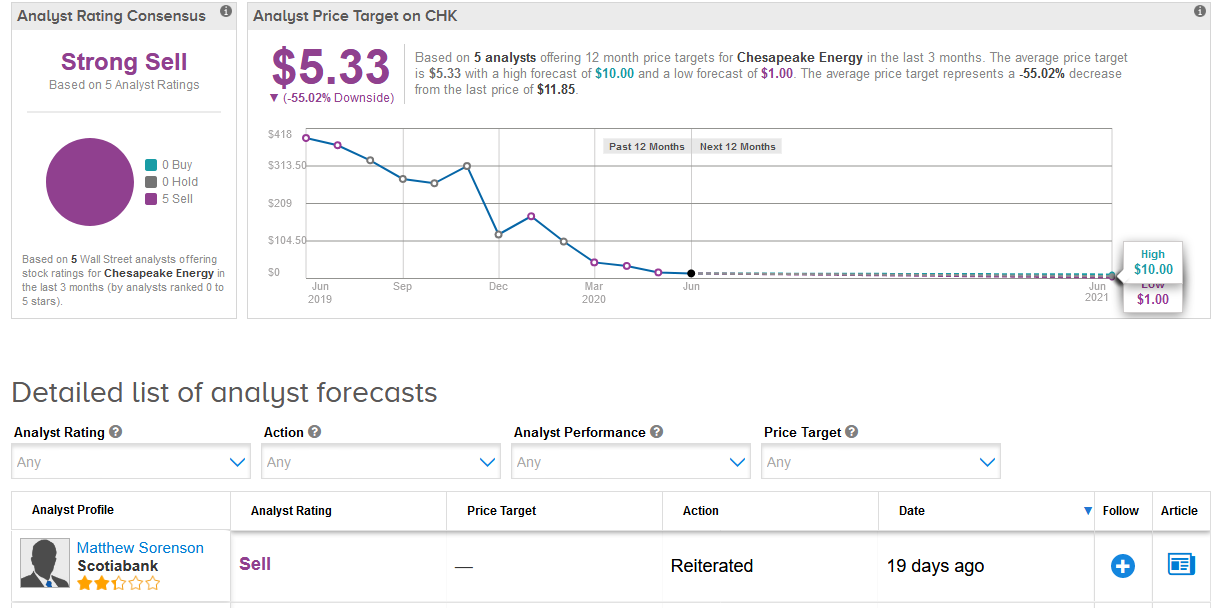

Unsurprisingly, the stock shows a Strong Sell Street consensus, with 5 Sell ratings. Meanwhile the average analyst price target stands at $5.33, indicating 55% downside potential in the shares over the coming year.

Earlier this month Scotiabank analyst Matthew Sorenson noted that if bankruptcy proceedings are forthcoming, about $7 billion in impairment value would need to be overcome before common equity holders received any value for their shares. Sorenson reiterated a Sell rating on the stock. (See Chesapeake stock analysis on TipRanks).

Related News:

Chesapeake Energy To File For Bankruptcy, Potentially This Week- Report

Bankrupt Hertz Tanks 24% Amid Plans To Sell $500 Million In New Shares

Bankrupt Hertz Pops 51% In Pre-Market On $1 Billion Share Sale Plan