Dave & Buster’s Entertainment, Inc. (PLAY) delivered strong quarterly results backed by the majority of its stores remaining open in the reported quarter with capacity limitations and reduced operating hours. Shares were up around 5% in pre-market trading at the time of writing.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Dave & Buster’s operates entertainment and dining venues with the concept of EAT.DRINK.PLAY, all under one roof.

Earnings for the quarter stood at $0.40 per share, compared to a loss of $1.37 per share in the prior-year period, and more than outpaced analysts’ estimated loss of $0.16 per share.

Revenue climbed 66% year-over-year to $265.34 million and surpassed Street estimates of $257.98 million.

Comparable store sales grew 56.5% year-over-year. The prior year’s store sales were mainly impacted by COVID-19 related closures. (See Dave & Buster’s stock analysis on TipRanks)

Brian Jenkins, the company’s CEO said, “We saw a significant improvement in demand across our store base in the first quarter, including at our recently re-opened New York and California stores…Our brand is back, we have a solid financial foundation, and we are ready to move full speed ahead into summer.”

For the second quarter, the company forecasts revenue to fall in the range of $335 – $350 million, while analyst estimates are pegged at $287.4 million.

Anticipating a solid Q1 performance, Raymond James analyst Brian Vaccaro maintained a Buy rating on the stock on June 8 and said, “Combined with the ongoing vaccine rollout which supports increased confidence that industry conditions can gradually begin to normalize in 2021, we are optimistic that D&B’s fundamentals and stock valuation can recover towards pre-COVID levels offering further upside from current levels.”

Vaccaro assigned a price target of $55 to the stock, which implies 24.8% upside potential to current levels.

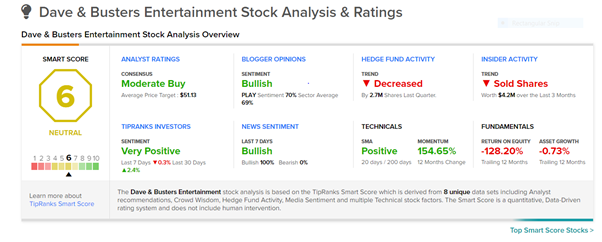

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 5 Buys, 3 Holds, and 1 Sell. The PLAY average analyst price target of $51.13 implies 16% upside potential from current levels. Shares have exploded 201.3% over the past year.

According to TipRanks’ Smart Score ranking system, PLAY gets a 6 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

FuelCell Energy Reports Disappointing Q2 Results; Shares Plunge 10.7%

Lovesac Delivers Blowout Q1 Earnings; Shares Rise

Eastman Chemical Inks $800M Deal for Sale of Tire Additives Business