Datadog, Inc. (DDOG), a monitoring and security platform for cloud applications, delivered blowout second-quarter results, aided by strong demand from large customers. Shares closed at a record high of $132.47 on August 5, reflecting a 15% gain.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company reported adjusted earnings of $0.09 per share, growing 80% compared to the year-ago period and easily beating analysts’ estimates of $0.03 per share.

Furthermore, revenue climbed 67% year-over-year to $233.55 million, and outpaced the Street’s estimate of $212.46 million.

Notably, Datadog’s customers with annual recurring revenue (ARR) of $100,000 or more grew 59% to 1,610 customers, compared to the prior-year quarter. (See Datadog stock charts on TipRanks)

Encouragingly, Olivier Pomel, co-founder and CEO of the company, said, “We saw broad-based strength across customer segments and products…Our high growth at scale demonstrates that we continue to be a trusted partner in our customers’ digital transformation and cloud migration journeys.”

Based on the strong second-quarter performance, the company raised its guidance for Q3 and full year 2021. For the third quarter, the company projects revenue and adjusted earnings to land between $246-$248 million and $0.05-$0.06 per share, respectively.

For full year 2021, the company guided for revenue of $938-$944 million, substantially better than the consensus estimate of $886 million. Earnings are expected to range from $0.26-$0.28 per share, compared to the Street’s call of $0.16 per share.

Following the company’s stellar performance, Monness analyst Brian White reiterated a Buy rating on the stock and lifted the price target to $160 (20.8% upside potential) from $103.

The analyst believes that Datadog stands to benefit from the improving global economy coupled with the rapid digitalization driven by the pandemic. What’s more, he notes that the stock commands a high valuation compared to its peers thanks to its robust growth, secular tailwinds, and its cloud-native platform.

White added, “As Datadog continues to aggressively invest back into the business and seeks to expand its customer base around the world, the company’s profitability (i.e., losses) remains well below its long-term potential at maturity.”

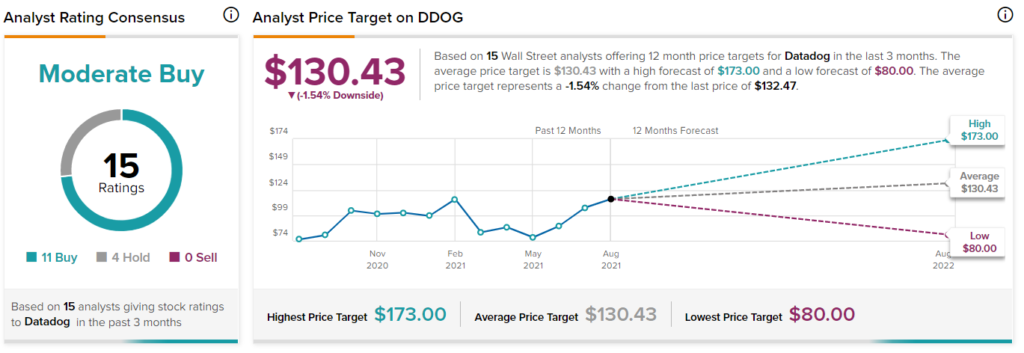

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 11 Buys and 4 Holds. The average Datadog price target of $130.43 implies 1.5% downside potential to current levels.

Related News:

HubSpot Reports Robust Q2 Results and CEO Transition; Shares Pop

Spirit AeroSystems Reports Narrower-than-Feared Q2 Loss; Shares Fall

Wynn Resorts Exceeds Q2 Expectations as Properties Re-Open