British cybersecurity firm Darktrace (GB:DARK) posted its trading update for the financial year 2022 on Tuesday – and the cyber security pioneer now expects to generate a revenue of $417 million, 48% higher than the previous year.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

It increased its profit margin outlook to 19.5% instead of 15-17% as previously forecast.

Stock declined post-pandemic

Amid the war in Ukraine and increased cyber threats, the British Government has encouraged organisations to enhance their security, which is a favourable environment for companies such as Darktrace.

It provided upbeat guidance for the next financial year, projecting annual recurring revenue (ARR) growth of 31-34%.

The company’s customer base grew as it added 500 new clients. Darktrace’s customer base is now over 7,400.

Darktrace Chief Executive Poppy Gustavson said, “Against a turbulent geopolitical background, it’s no surprise that long-term cyber risk is an even higher priority for chief information and security officers and senior executives.”

In the update, Darktrace also announced the launch of new technology, PREVENT, an interconnected set of AI products which pre-emptively stops cyber attacks.

Despite the sector it operates being robust and the revenues growing, the stock is currently at a relatively low point. The company was listed on the London Stock Exchange in 2021 and it received a lot of investor interest, increasing by 200% in six months.

However, after the pandemic was over, Darktrace – like many other tech stocks – also started falling and at one point fell below 300p.

View from the city

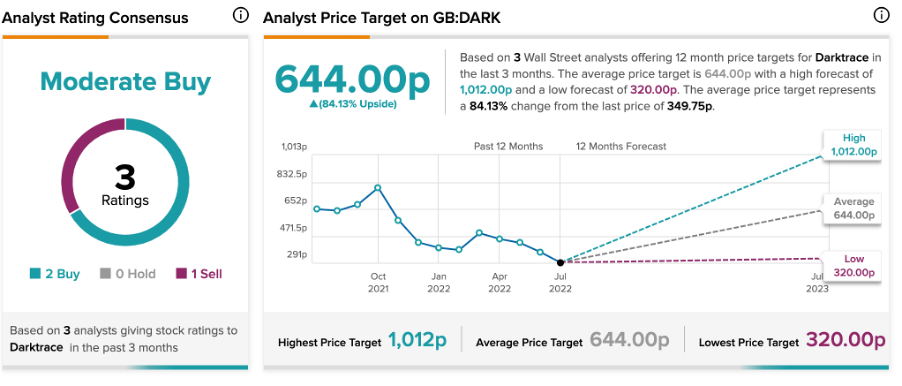

According to TipRanks’ analyst rating consensus, Darktrace stock has a Moderate Buy rating. The rating is based on two Buy and one Hold ratings from analysts.

The average Darktrace price target is 644p, which indicates a potential for huge growth of 84.13%. Analyst price targets range from a low of 320p to a high of 1,012p.

Out of the three analysts who rated the stock, Alex Henderson is extremely bullish on this stock. His target price for the stock is 1,012p, implying an upside potential of 188%.

Henderson is a five-star rated analyst on TipRanks and has a success rate of 54%.

Outlook

Darktrace has rapidly expanded its customer base and its revenue grew by 58% over the last two years. The stock is volatile, but mainly because it corrected itself post-pandemic. However, the positive numbers and the outlook pave the way for a potential bullish phase.