Much appeared to be resting on Microsoft’s (NASDAQ:MSFT) shoulders ahead of the newly crowned world’s most valuable company’s latest quarterly readout. The big rally seen over the past year has been fueled by AI hype, with Microsoft central to the surge. As such, the tech giant’s FY2Q24 results were considered a litmus test to find out whether the rally has legs.

Well, Microsoft offered a strong case for ongoing success. For the fifth consecutive quarter, the company delivered record quarterly revenue with the top-line figure landing at $62.02 billion, representing a 17.7% year-over-year increase and outpacing the Street’s forecast by $890 million. The most eye-catching metric came from the Intelligent Cloud business, which includes the Azure cloud service, and reached $25.8 billion compared to the Street’s expectation of $25.3 billion. Within that segment, Azure and other cloud services showed revenue growth of 30% (28% in constant currency), coming in above the 27% Wall Street expected.

At the other end of the spectrum, the company delivered handsomely too, as EPS of $2.93 beat the analysts’ forecast by $0.16.

Maybe putting a bit of a dent in the proceedings, the outlook was a tad light, with Microsoft anticipating fiscal third-quarter revenues in the range between $60 billion and $61 billion, at the midpoint below the Street’s forecast of $60.93 billion.

While that might amount to a slight disappointment, Wedbush’s Daniel Ives, a 5-star analyst rated in the top 3% of the Street’s stock pros, is having none of it, going as far as to say the results should be “hung in the Louvre” as a lesson in how to do it right.

“Microsoft delivered its FY2Q24 results that featured top and bottom-line beats as the company continues investing heavily into integrating AI into its overall portfolio to accelerate growth while focusing intently on bottom-line expansion,” the top analyst said. “This was another masterpiece quarter and guidance from Nadella that will send a major ripple impact across the tech world as the AI Revolution is here.”

Quantifying that bullish stance, Ives maintained an Outperform (i.e., Buy) rating on Microsoft shares to go along with a $450 price target, suggesting the stock will post additional growth of ~12% over the course of the year. (To watch Ives’ track record, click here)

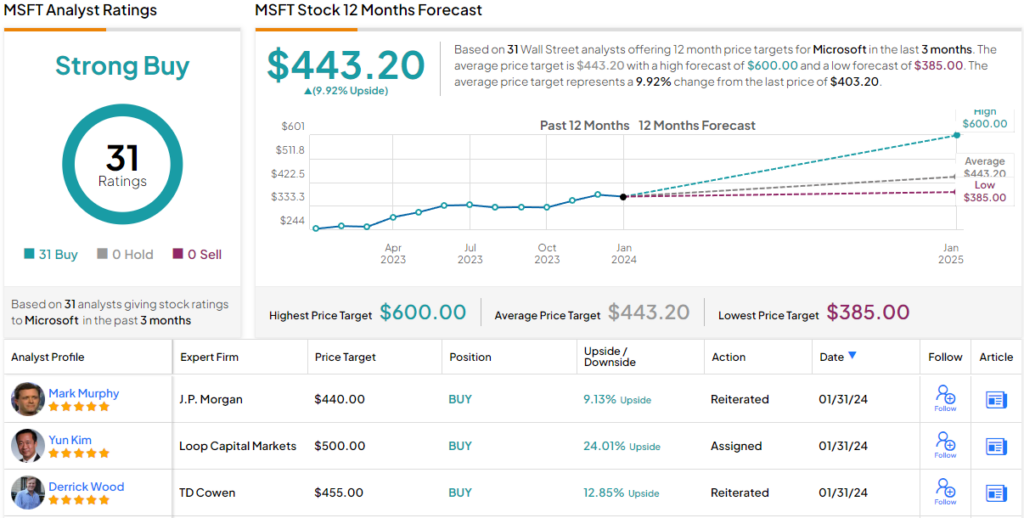

The rest of Wall Street agrees 100% with Ives. All 31 current MSFT reviews on file are positive, naturally resulting in a Strong Buy consensus rating. The average target stands at $443.20, making room for 12-month returns of ~10%. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.