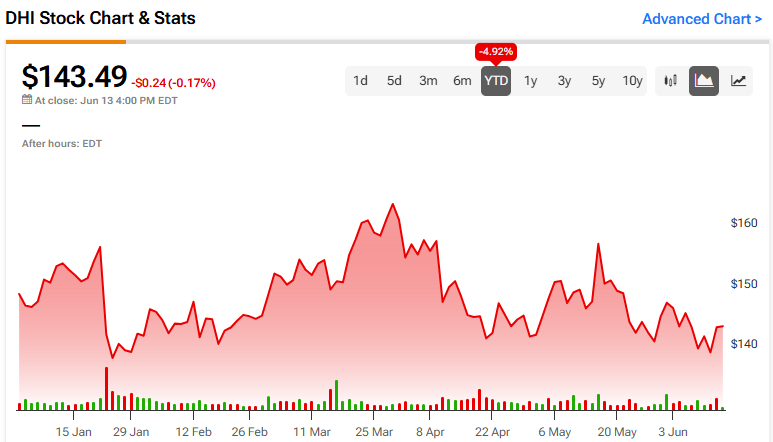

D.R. Horton (NYSE:DHI) has lagged the S&P 500 (SPX) so far in 2024 despite very positive operational developments in the first six months of its fiscal year. I would attribute the underperformance firstly to a weak outlook for the remainder of the year (which is set to be a temporary slowdown) and secondly to no monetary policy easing by the Federal Reserve year-to-date.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

I think the Federal Reserve will change its policy stance over the coming months, which, in turn, will boost the housing market and reinvigorate D.R. Horton’s operating performance in 2025. Additionally, the stock’s valuation looks attractive. For these reasons, I am bullish on DHI stock.

D.R. Horton Q2-2024 Results

D.R. Horton has a fiscal year ending in September. In Q2 2024 (the quarter ending in March 2024), the company delivered revenue growth of 14% year-over-year, an acceleration from the 11% increase in the first six months of the fiscal year. Earnings per share were $3.52/share in Q2 2024, up 29% year-over-year, again, this was better than the 15% increase for the first six months to $6.34/share.

The strong performance was exclusively driven by higher Homebuilding results as the company’s smaller business divisions (Financial Services, Forestar (residential lot development), and Rental) delivered marginally lower pre-tax income in the quarter.

A Soft 2024 Outlook

For the third quarter of 2024, D.R. Horton expects to generate the following:

- Revenue of about $9.6 billion, 1% lower year-over-year.

- Home sales gross margin of about 23.25%, in line with Q2 2024.

For the full year 2024, D.R. Horton expects to generate:

- Revenue of about $37.2 billion, 5% higher year-over-year.

- Cash flow of $3 billion from homebuilding operations alone, allowing it to allocate $0.4 billion to dividends and $1.6 billion to share repurchases.

Overall, I would say the guidance for the remainder of the year is quite disappointing, given the accelerating performance observed in Q2 2024 relative to Q1 2024. Alternatively, the guidance could be described as conservative, with a high 10.7% growth rate recorded in Q3 2023 also playing a role (a tough comparison problem).

Nevertheless, I reckon that the company is on track to beat its 2023 earnings of $13.82/share, largely on the back of strong performance in H1 2024 and stable margins for the remainder of the year.

Conservative Balance Sheet

D.R. Horton runs a very conservative balance sheet, which was further strengthened over the past year. Its net-debt-to-total-capital ratio (which shows what percentage of the capital employed in the business is funded by debt as opposed to equity) improved to 20% in Q2 2024 from 22.4% in the prior-year period.

DHI Can See Relief if Interest Rates Decrease

At its June policy meeting, the Federal Reserve projected one 0.25% interest rate cut in 2024, to be followed by four quarter-point moves in each of 2025 and 2026. Indeed, current futures pricing projects a FED funds rate of about 4.25-4.50% in July of 2025, already 1% lower than the current 5.25-5.50% range.

Furthermore, chair Powell noted that risks to the economy and inflation were now more balanced. With an inverted yield curve (the 10-year treasure note currently yields about 4.24%, well below the FED funds rate) and unemployment increasing to 4% from a low of 3.4% set in 2023, the risks of a recession have materially increased, in my opinion. Historically, an inverted yield curve and a 0.3-0.5% increase in the unemployment rate have been associated with recessions down the line.

Still, lower rates set by the Federal Reserve should translate into lower mortgage rates down the line, boosting demand for housing. As a result, the slowdown in activity projected by D.R. Horton for the remainder of Fiscal 2024 is likely to give way to a rebound starting as soon as 2025.

Attractive Valuation

As I expect D.R. Horton to generate about $14/share in Fiscal 2024 earnings and benefit from lower rates in 2025 and 2026, the current price-earnings ratio of around 10 seems quite attractive, especially since it is the result of a conservative balance sheet.

Is DHI Stock a Buy, According to Analysts?

Turning to Wall Street, D.R. Horton earns a Moderate Buy consensus rating based on 10 Buys, three Holds, and two Sell ratings. Additionally, D.R. Horton stock’s average price target is $168.85, implying 17.3% upside potential.

The Takeaway

D.R. Horton has produced strong revenue and earnings growth so far in Fiscal 2024, but the firm expects a slowdown for the remainder of the year. I think DHI will benefit from the shift in monetary policy by the Federal Reserve, widely expected to start over the coming months. With an undemanding valuation and a positive tailwind from interest rates in the coming years, I think D.R. Horton is worth considering at its current price.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue