D.A. Davidson raised Applied Materials’ price target after the world’s largest flat panel display chip maker reported 3Q earnings that topped analysts’ estimates. Shares gained 3.9% on Friday.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

D.A. Davidson analyst Thomas Diffely lifted the price target on Applied Materials (AMAT) to $70 (3.5% upside potential) from $55, and kept a Hold rating on the stock. In a note to clients, Diffely wrote that the chipmaker “posted a solid Q3 earnings beat and raise for FY20 thanks to its execution and strong demand environment”. The analyst added that “with supply disruptions mitigated, the company is working through a record backlog and expects its momentum to continue for the rest of the year.”

Mizuho analyst Vijay Rakesh increased the stock’s price target to $77 (13.9% upside potential) from $70 and reiterated a Buy rating. Rakesh noted that the company exited 3Q with a strong backlog. Applied Materials “sees strength in the second half of the year being driven by Foundry and DRAM spending,” he added.

On Aug. 14, Applied Materials reported that 3Q EPS jumped 43% to $1.06 year-on-year, beating analysts’ expectations of $0.95. Revenues rose 23% to $4.40 billion year-over-year and surpassed Street estimates of $4.18 billion.

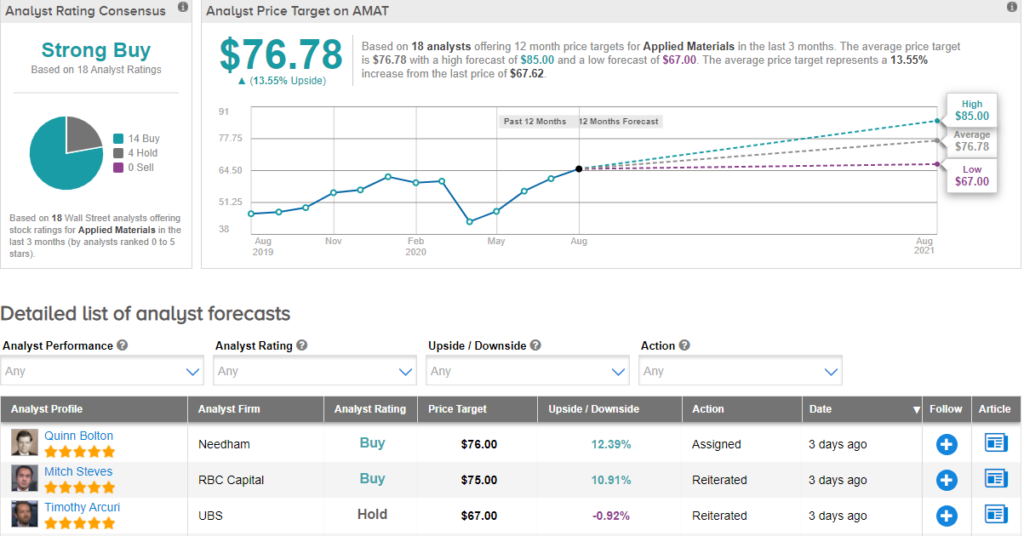

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 14 Buys versus 4 Holds. The average price target of $76.78 implies upside potential of about 14% to current levels. (See AMAT stock analysis on TipRanks).

Related News:

JPMorgan Lifts PT On Farfetch As 2Q Sales Beat

Barclays Cuts Micron’s PT On Chip Demand Woes

Raymond James Lifts Nvidia’s PT Ahead Of 2Q Results