Shares of cybersecurity solution provider, CyberArk Software, dropped 6.4% on Tuesday after its 3Q earnings guidance fell short of expectations. Nonetheless, its 2Q earnings topped analysts’ estimates.

CyberArk (CYBR) anticipates 3Q adjusted EPS to be between $0.19 and $0.33, which is lower than the Street estimate of $0.34. Also, the mid-point of CyberArk’s revenues guidance range of $107-$115 million missed analysts’ expectations of $111.5 million.

As for 2Q, its adjusted EPS of $0.42 beat Street estimates of $0.27. Revenues grew 6.3% to $106.5 million surpassing analysts’ expectations of $101.2 million.

Despite 2Q earnings beat, Needham analyst Alex Henderson maintained his Hold rating on the stock and said “We think the increasing orientation to cloud solutions validates a more aggressive shift to Term-based on-prem deals. We appreciate the desire for model stability longer-term, but the margin contraction needed to get there, and what we view as growing competition in cloud, keep us on the sidelines.”

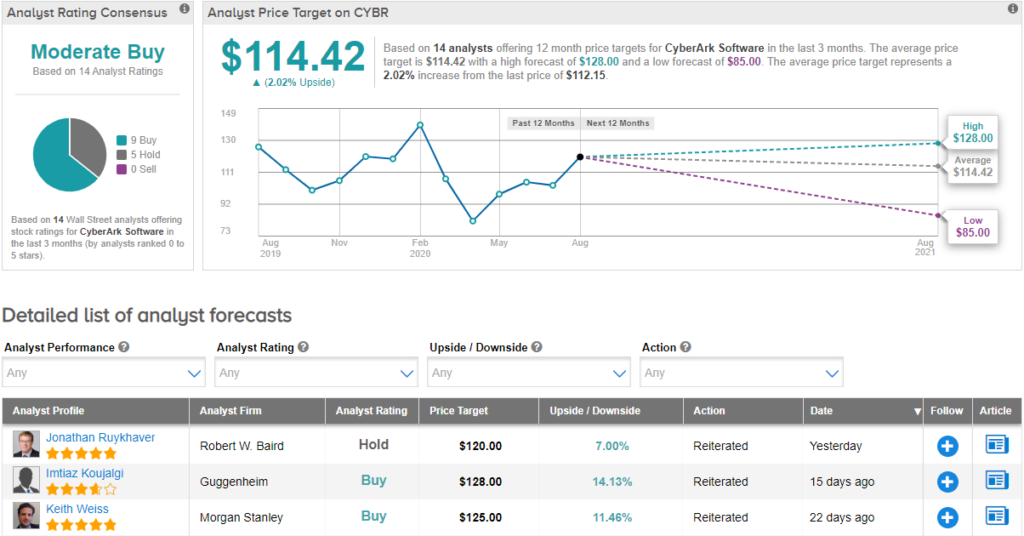

Currently, CYBR has a Moderate Buy analyst consensus. The average price target of $114.42 implies upside potential of 2%. (See CYBR stock analysis on TipRanks).

Related News:

Tyson Foods’ 3Q Earnings Top Estimates; Names New CEO

Ralph Lauren Drops 7% On Wider-Than-Expected 1Q Loss

Jefferies Lifts PT On AMD After Intel Chip Delay