CVS Health (NYSE:CVS) is cutting jobs ahead of its Q2 earnings, the Wall Street Journal reported. Per the report, the healthcare company will eliminate 5,000 corporate positions to reduce costs. Furthermore, it is trimming down travel expenses and focusing on productivity measures to cushion margins. The company is scheduled to report its Q2 earnings on Wednesday, August 2, 2023.

As CVS optimizes costs to drive profitable growth, let’s check what Wall Street analysts are projecting for Q2.

Analysts’ Q2 Projections

Wall Street analysts expect CVS to report revenues of $86.41 billion in the second quarter, up from $80.64 billion in the prior-year quarter. Further, the Q2 sales are also expected to improve on a quarter-over-quarter basis, reflecting growth across each of its businesses.

While sales are projected to increase, analysts see a continued decline in earnings. Wall Street analysts expect CVS to post earnings of $2.13 a share in the second quarter, down from $2.40 reported in the year-ago quarter. Moreover, analysts’ consensus estimates suggest a sequential decline in EPS. The slide in earnings reflects lower COVID-related contributions.

On July 14, Mizuho Securities analyst Ann Hynes lowered the price target on CVS stock to $88 from $120, citing “multiple compression in retail pharmacy.” Nonetheless, the analyst maintained a Buy recommendation on the stock.

Besides for Hynes, TD Cowen analyst Charles Ryhee and JPMorgan analyst Lisa Gill lowered their price targets on CVS stock ahead of Q2 earnings.

Is CVS a Good Stock to Buy Now?

With 13 Buy and four Hold recommendations, CVS stock sports a Strong Buy consensus rating. These analysts’ average price target of $93.35 implies 24.98% upside potential from current levels.

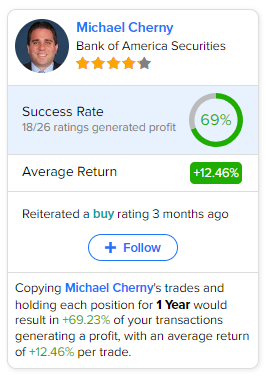

Investors should note that Michael Cherny of Bank of America Securities is the most accurate analyst for CVS stock, according to TipRanks. Copying Cherny’s trades on CVS stock and holding each position for one year could result in 69% of your transactions generating a profit, with an average return of 12.46% per trade.

Insights from Options Trading Activity

The options traders are pricing in a 4.35% move on earnings, which is greater than the previous quarter’s earnings-related move of -3.69% and the average 1.31% move in the last eight quarters.

Questions or Comments about the article? Write to editor@tipranks.com