Pharmacy operator and healthcare company CVS Health (CVS) is adding four new members to its Board of Directors to pacify Glenview Capital Management. This hedge fund holds $700 million in CVS stock and has been pushing for changes to its business.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Among the new CVS Board members is Glenview CEO Larry Robbins. Joining him are Leslie Norwalk, Guy Sansone, and Doug Shulman, bringing the total number of board seats up to 16. Each of these new board members brings with them financial or healthcare sector experience.

In addition to joining the CVS Board, these new members will contribute their skills to the company’s various committees. Norwalk will join the Health Services Committee, Sansone will join the Audit Committee, and Shulman will join the Management Planning and Development Committee.

CVS Board Seats Are Part of a Larger Deal

CVS Health is adding these new Board members to quell complaints from Glenview Capital Management. As part of that agreement, Glenview has entered into a confidentiality agreement that covers customary confidentiality, standstill, and other provisions.

The complaints against CVS concern its performance over the past several quarters. CVS hasn’t been performing the best, with its health insurance division holding it back in recent earnings reports. That even saw the healthcare and pharmacy operator replace its CEO, enact a strategic review, and change out its health insurance head in the last few months.

These issues have weighed on CVS stock, dropping 26.96% year-to-date and 16.83% over the past 12 months. However, today’s news did result in the shares rallying 3.3% during morning trading.

What’s Next for CVS Stock?

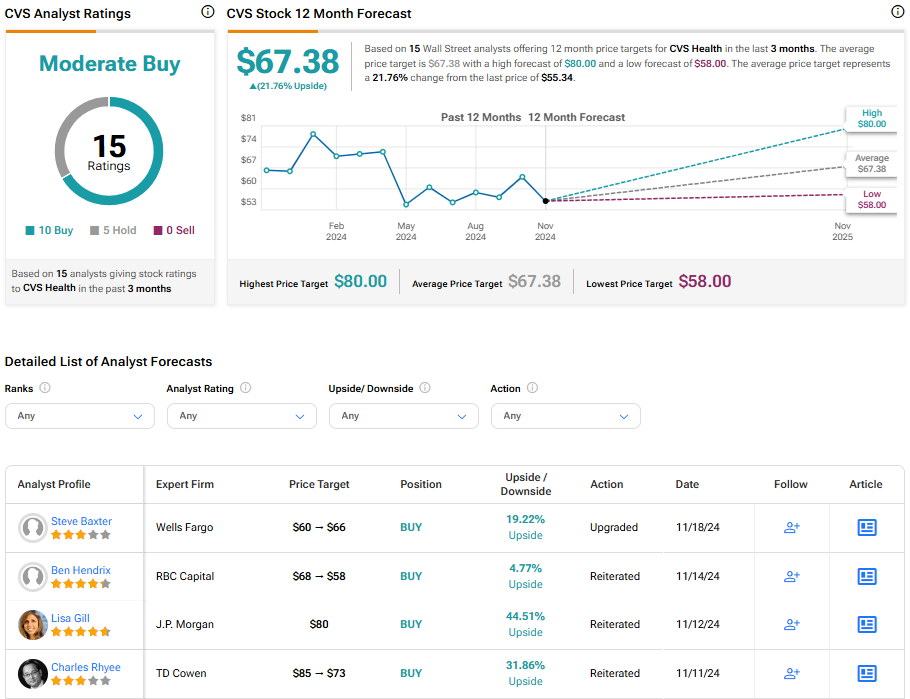

Turning to Wall Street, the analysts’ consensus rating is Moderate Buy based on 10 Buy and five Hold ratings for the shares over the last three months. That comes with an average price target of $67.38, with a high of $80 and a low of $58. This represents a potential upside of 21.76%.