Currys PLC (GB:CURY) reported strong operational and financial results for the fiscal year ended April 2022, but the company has warned of trouble ahead.

The company has lowered its earnings guidance for the next two years due to rising inflation and declining customer spending power.

Currys has launched a ’12 month pay delay’ scheme, applicable on purchases over £99, to allow customers to buy even if they are feeling the pinch.

Alex Baldock, Group Chief Executive, said, “Our scale as an international market leader, our grip on costs, and our strong relationships with suppliers will allow us to manage inflationary headwinds and keep amazing technology within reach of everyone, even now. That’s what Currys exists to do, and it’s never mattered more.”

The company deals in technology products and services via online and offline stores.

Shares tumbling down

Currys’ stock performance has been gloomy, with shares trading 43.8% down year-to-date. The company’s direct competitor in the UK, AO World’s (GB:AO) shares, were also down 60% during the same period.

AO World plans to raise £40 Million to improve its liquidity after its disappointing stock performance.

Currys, however, believes that its position in the market and its tighter cost control measures will help it weather tough times more easily than its competitors.

Full-year results beating expectations

Currys’ store sales were up by 24% globally as customers came back to stores post-pandemic. Online sales, on the other hand, fell by 29%. As a result, the company’s total sales were slightly down by 2% on a year-on-year basis.

Despite the marginal slowdown in sales, Currys reported a 19% increase in its pre-tax profits to £186 Million. The company was able to beat its estimate of £155 million, large due to its cost-saving programme.

View from the city

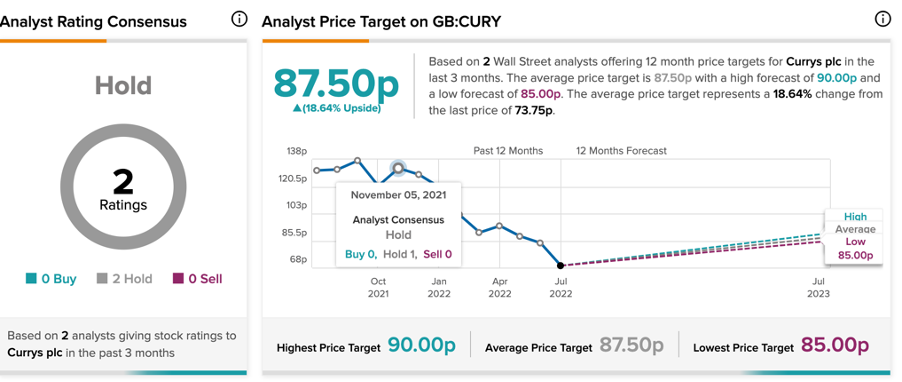

According to TipRanks’ analyst rating consensus, Currys stock has a Hold rating. The rating is based on hold ratings from two analysts.

The average Currys price target is 87.5p, with an upside potential of 18.6%. The analyst price targets range from a low of 85p to a high of 90p.

Outlook

The company is well placed in the market to face competition and economic uncertainty. However, as demand weakens, investors expect the stock to recover.