Curaleaf Holdings announced on Dec. 22 that Curaleaf CEO Joseph Lusardi had exercised options to purchase 900,114 subordinate voting shares (SVS) of the company’s common stock on Dec. 7. As a result, the total number of options exercised by Lusardi increased to the equivalent of 3.5 million shares in 2020.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

SVS refers to the restricted shares that carry a right to vote where another class of shares outstanding carries a greater right to vote, on a per-share basis.

Additionally, Lusardi sold 500,000 shares on Dec. 17 to accommodate personal year-end tax planning. He had informed the company that the sales were for tax purposes and that he did not expect to sell additional shares at this time.

“Joe and I continue to be significant shareholders of Curaleaf as we believe the cannabis industry’s growth prospects are unmatched by any other major U.S. industry, as new consumers enter the regulated market and more states approve legalization,” said Curaleaf (CURLF) Chairman Boris Jordan. “As a major shareholder of Curaleaf, I reiterate that I have no plans to sell a single share of Curaleaf and remain fully committed to the growth and success of the company.”

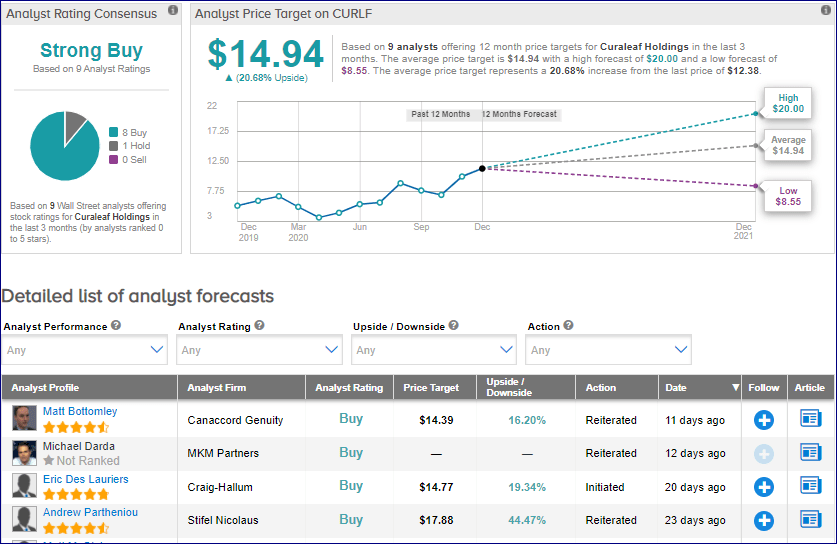

On Dec. 3, Craig-Hallum analyst Eric Des Lauriers initiated coverage of CURLF stock with a Buy rating and a $19 price target (53% upside potential).

Des Lauriers believes Curaleaf has the brands, management team, and access to capital to be a top 3 player in each of its markets, and as the most liquid U.S. cannabis stock, he thinks it will be a top beneficiary of the incoming wave of institutional capital following US federal reform. (See CURLF stock analysis on TipRanks)

From the rest of the Street, the stock scores an analyst consensus of a Strong Buy based on 8 Buys and 1 Hold. The average analyst price target of $14.94 implies upside potential of close to 21% at current levels.

Related News:

TriplePoint Venture Growth Declares Special Dividend; Street Sees 10% Upside

Honeywell To Buy Sparta Systems For $1.3B; Stock Up 17% YTD

U.S. Bancorp Okays $3B Share Buyback Plan; Stock Down 23% YTD