Indiana-based industrial behemoth Cummins (CMI) designs, manufactures, and distributes power generation, filtration, and engine products.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Let’s take a look at the company’s financial performance and what has changed in its key risk factors that investors should know. (See Insiders’ Hot Stocks on TipRanks)

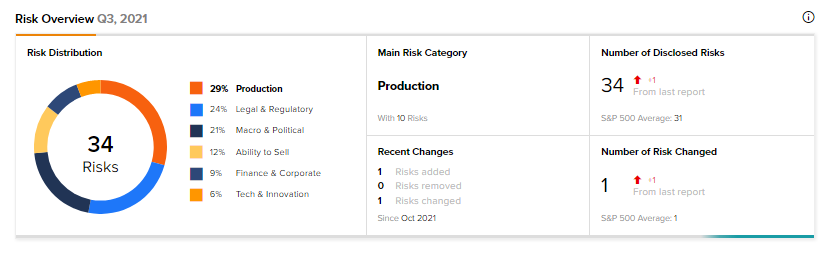

Cummins Risk Factors

According to the new TipRanks Risk Factors tool, Cummins’ main risk category is Production, which accounts for 29% of the total 34 risks identified. The next two major risk factor contributors are Legal & Regulatory, and Macro & Political, at 24% and 21%, respectively.

Cummins has added one risk factor under the Legal & Regulatory category.

Under the Regulation sub-category, the company said, “The U.S. government’s pending rules and regulations concerning mandatory COVID-19 vaccination of U.S.-based employees of companies that work on or in support of federal contracts, or have 100 or more employees, could materially and adversely affect our results of operations, financial condition and cash flows.”

President Biden signed an executive order on September 9 requiring all firms with U.S. government contracts to ensure that their U.S.-based staff is fully vaccinated against COVID-19. Additional vaccination requirements might be introduced in addition to the above.

Cummins warns that enforcing these immunization requirements might lead to worker attrition.

On a brighter note, the overall sector average for the Finance & Corporate risk factor is 48%, higher than the average risk in that category for Cummins, which is 9%.

Wall Street’s Take

Following the Q3 earnings release, Credit Suisse analyst Jamie Cook reiterated a Buy rating on the stock and increased the price target to $304 from $295, which implies upside potential of 27.8% to current levels.

Consensus among analysts is a Moderate Buy based on five Buy ratings and four Hold ratings in the last three months. The average CMI price target is $276.78, which implies upside potential of 16.4% from current levels.

Related News :

What do Exact Sciences’ New Risk Factors Tell Investors?

Understanding T-Mobile’s Newly Added Risk Factor

Skillz Drops 10% on Quarterly Loss