Cintas (CTAS) stock gained 5.4% yesterday and hit a new 52-week high of $773.78. The upside came after the company delivered better-than-expected fiscal fourth-quarter earnings and provided a strong outlook.

CTAS provides businesses with uniform rental services and makes fire extinguishers, first aid, restroom supplies, and other products.

It is worth highlighting that the company has a strong track record of beating expectations. Cintas has exceeded earnings estimates every quarter since Q1 2021.

CTAS: Q4 Highlights

Cintas reported adjusted earnings of $3.99 per share, which increased 19.8% year-over-year and surpassed the consensus estimate of $3.79. Furthermore, the company’s revenue grew 8.2% year-over-year to $2.47 billion, which was in line with the analysts’ expectations.

Segment-wise, revenues from Uniform Rental and Facility Services expanded 7.8% year-over-year to $1.91 billion, and revenues from the Other segment rose 9.5% to $0.56 billion.

Additionally, the company’s operating income as a percentage of revenue came at an all-time high of 22.2% and compared favorably to 20.6% in the same quarter last year. This suggests that CTAS is efficiently managing its operations and maintaining profitability.

Key Growth Drivers

Despite the ongoing economic concerns and inflation pressures, the company delivered a strong performance in Q4. Cintas Chief Financial Officer, Mike Hansen, attributed this to several factors, including new customer growth and improvements in the supply chain. Also, he noted that the company’s efforts to streamline operations helped increase efficiency and supported Q4 performance.

Furthermore, CEO Todd Schneider highlighted that the company’s customer retention rate remained strong during the quarter.

Positive Outlook for Fiscal 2025

Based on the above factors, Cintas expects continued success in the current fiscal year. The company anticipates that revenue will range from $10.16 billion to $10.31 billion. Also, earnings per share are expected to come in the range of $16.25 to $16.75.

Importantly, these projections are slightly higher than analyst estimates of $10.26 billion in revenue and $16.43 in earnings per share.

Is CTAS a Good Stock to Buy?

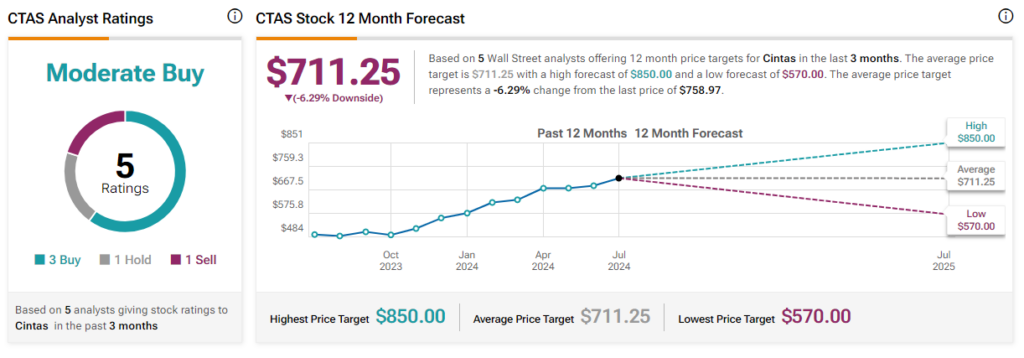

Following the earnings release, two analysts gave the stock a Buy rating.

Overall, Cintas has a Moderate Buy consensus rating on TipRanks. This is based on three Buy, one Hold, and one sell recommendations. The analysts’ average price target on CTAS stock of $711.25 per share implies a 6.3% downside potential. However, it’s worth noting that the price target will likely change following the earnings report.

Shares of the company have gained 27.2% in the past six months.