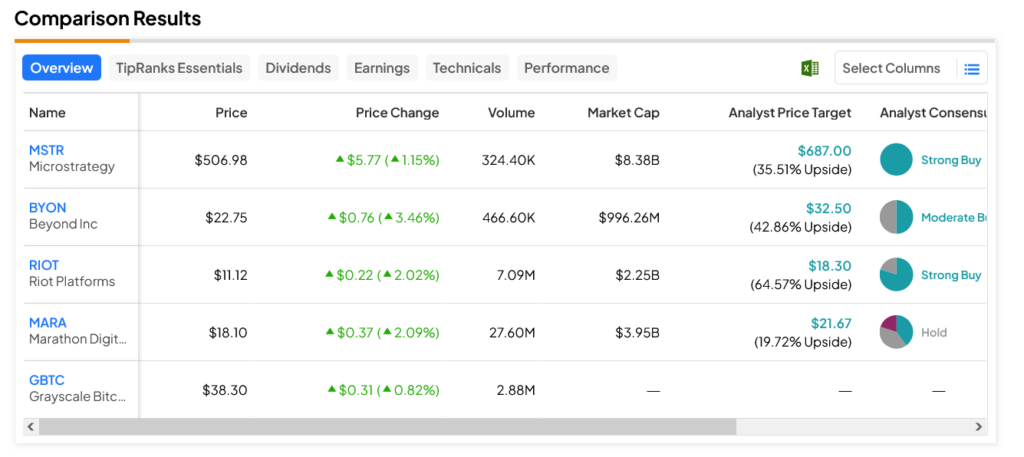

While the Securities and Exchange Commission (SEC) fought tooth and nail against the notion of Bitcoin exchange-traded funds (ETFs), the word of judges forced a turnaround. Now, there are signs of similar opposition toward options on those ETFs, and some believe that may slow interest in the ETFs themselves. That’s not what several Bitcoin stock investors thought, though; Grayscale Bitcoin Trust (NYSEARCA:GBTC) was up fractionally, while Microstrategy (NASDAQ:MSTR) was up modestly. Meanwhile, Marathon Digital (NASDAQ:MARA) and Riot Platforms (NASDAQ:RIOT) added just over 2%, and Beyond Inc (NYSE:BYON) added nearly 3.5% in Thursday afternoon’s trading.

Several industry sources have noted that getting options approved for use on these newly approved ETFs will likely take some time. Without the full range of options for investors, they note, the appeal of the ETFs themselves might be reduced as a result. Since many investors will use put or call options as a means to hedge against downturns or amplify their purchasing power, not having those options may keep some money out of the pool altogether while they wait for the options to be made available.

Or, Then Again, Maybe Not

While this sounds like a troubling development, there are some signs that things could continue to stay brisk in the crypto ETF trading space. First, a report notes that the major new Bitcoin ETFs have seen good business already, with a still-ongoing four-day streak of net inflows coming into the funds. Further, some even project that the rise of Bitcoin ETFs could reduce volatility in Bitcoin itself, as the growth of ETFs will offer guidance for Bitcoin pricing itself. That will take some volatility out of the system as the prices of ETFs will offer something comparatively new for cryptocurrency: perspective.

Which Bitcoin Stocks Are a Good Buy Right Now?

Turning to Wall Street, the leader among those mentioned is RIOT stock, as this Strong Buy with an average price target of $18.30 per share offers investors a 64.57% upside potential. Meanwhile, MARA stock is the laggard, as this Hold-rated stock can only offer a 19.72% upside potential on an average price target of $21.67.