Cybersecurity provider CrowdStrike Holdings (NASDAQ: CRWD) has reported better-than-expected results for the fiscal first quarter ended April 30, 2022.

Despite its solid results and an improved outlook for FY23, shares of the company slipped 2.3% to close at $170.10 in Thursday’s extended trading session.

Results in Detail

Total revenues grew 61% year-over-year to $487.8 million, surpassing analysts’ estimate of $464 million. While Subscription revenue jumped 63.5% year-over-year to nearly $460 million, Professional services revenue rose 30% from the year-ago quarter to $28 million.

Annual Recurring Revenue (ARR) at the end of the quarter stood at $1.92 billion, up 61% year-over-year.

Adjusted earnings per share (EPS) surged to $0.31 from $0.10 in the prior-year quarter. Analysts had expected the company to post earnings of $0.23 per share.

The CFO of CrowdStrike, Burt Podbere, attributed the impressive results to “continued strong customer adoption of the company’s core products, growing success with emerging product category and cloud modules, strong retention and expansion within the customer base and continued rapid new customer acquisition.”

Outlook

For the second quarter, CrowdStrike expects total revenues in the range of $512.7 million to $516.8 million and adjusted EPS of $0.27 to $0.28. Analysts expect the company to report revenues of $510 million and adjusted earnings of $0.24 per share.

Meanwhile, the company has raised its FY23 revenue guidance to the range of $2.1905 billion to $2.2058 billion from the previously issued outlook range of $2.1331 billion to $2.1632 billion. It now expects full-year adjusted EPS between $1.18 and $1.22, compared to the prior guidance range of $1.03 and $1.13.

Wall Street’s Take

Following the print, Stephens analyst Brian Colley noted that CrowdStrike’s first-quarter results surpassed Wall Street’s expectations “albeit by a lesser magnitude than in recent quarters.”

Colley also highlighted that the company added 1,620 net new subscription customers in the first quarter of FY23, compared to 1,638 in the fourth quarter of FY22. CrowdStrike ended the quarter with a total of 17,945 customers, up 57% year-over-year.

Further, Colley has maintained a Buy rating on CrowdStrike stock. He states that his estimates and price target are under review.

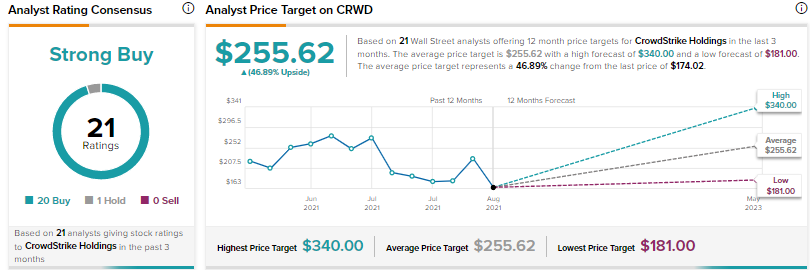

Overall, the Street has a Strong Buy consensus rating on the stock based on 20 Buys and one Hold. CrowdStrike’s average price target of $255.62 implies upside potential of 46.89% from current levels. Shares have declined 15% year-to-date.

Bloggers’ Stance

TipRanks data shows that financial bloggers are 87% Bullish on CrowdStrike, compared to the sector average of 65%.

Conclusion

CrowdStrike continues to benefit from the strong demand for cybersecurity products and solutions amid rapid digitization. Also, Wall Street analysts seem to be bullish on the company’s long-term prospects.

Read full Disclosure