Many investors panicked when the global IT outage turned Crowdstrike (CRWD) into a household name. The cybersecurity giant shed more than 40% of its value from peak to trough. While some investors rushed for the exits, I viewed the drop as a buying opportunity. A few months later, Crowdstrike shares has been proving the critics wrong, having rebounded dramatically. The company’s resilience, customer base, and long-term tailwinds are some of the stock’s potential catalysts.

Customers Are Sticking Around

Crowdstrike’s Q2 FY25 results and commentary suggest that most of its customers are sticking around, and that’s one of the reasons I’m bullish on the stock. A major concern after the global IT outage was that Crowdstrike would lose customers and see its growth substantially decelerate in future quarters. Investors also believed other cybersecurity firms would take market share from Crowdstrike.

However, Crowdstrike put those concerns to rest as it reported 32% year-over-year growth in its annual recurring revenue. Subscription revenue reached $3.86 billion as the company announced several new partnerships.

Crowdstrike CEO George Kurtz mentioned in the press release that the cybersecurity giant “emerge[d] as an even more resilient and even more customer-obsessed company.” Guidance suggests that revenue will continue to grow at an impressive pace. Q3 FY25 guidance of $981.1 million implies a 25% year-over-year growth rate from the $786.0 million top line for Q3 FY24. While that reflects lower revenue growth than for Q2 FY25 revenue, it’s still a metric investors would expect from a growth stock.

The Cybersecurity Industry Is Vital and Growing

The cybersecurity industry’s long-term trajectory and solid foundation are two other reasons that I’m bullish about Crowdstrike. Cybersecurity is projected to grow at an annualized 14.3% from now until 2032. Crowdstrike should exceed that growth rate since it’s a leading player in the industry.

With many investors worried Crowdstrike would lose traction, it isn’t easy to switch from one cybersecurity platform to another. The time and effort to switch to a different cybersecurity software is extensive. Furthermore, many clients have been using Crowdstrike for several years. That history of trust, plus Crowdstrike’s quick responsiveness, helped it retain many of its clients.

Customers could technically stop using cybersecurity to protect themselves, but it would result in significant losses. Businesses invest in cybersecurity tools because they understand the cost of a hack can be more costly than software. Some cyberattacks cost millions of dollars, and hackers are becoming more brazen as their tools and tactics advance.

Crowdstrike’s Subscription Model Makes It Easier to Scale

Crowdstrike’s subscription model is another reason that I am bullish on the stock. Some companies must sell the same number of products each year to maintain their revenue numbers. However, Crowdstrike gets a solid head start each year, based on its $3.86 billion in annual recurring revenue. The cybersecurity firm should exceed $4 billion in annual recurring revenue by the end of fiscal 2025.

The cybersecurity firm regularly builds on this foundation by signing new customers. However, it can also raise prices over time to command a higher average value per customer. While Crowdstrike’s hands are a bit tied when it comes to price hikes, the company should be back in a position to raise prices within the next 1-2 years. The company announced Crowdstrike Financial Services, which helps customers finance their investments in Crowdstrike software.

Crowdstrike Is Still Removed from All-Time Highs

Even though Crowdstrike has rallied from its early August lows, the cybersecurity firm is still more than 20% removed from its all-time high. This price disparity makes me bullish on the stock. While it may take a few quarters for Crowdstrike to fully adapt to the global IT outage, it’s clear that the company will remain a leader in the cybersecurity industry.

Meanwhile, GAAP net income continues to soar, which makes the valuation more attractive in the long run. Crowdstrike reported $47.0 million in Q2 FY25 earnings compared to $8.5 million in the same quarter last year. Rising profit margins should help the stock price even if revenue growth temporarily decelerates.

Is Crowdstrike Stock a Buy?

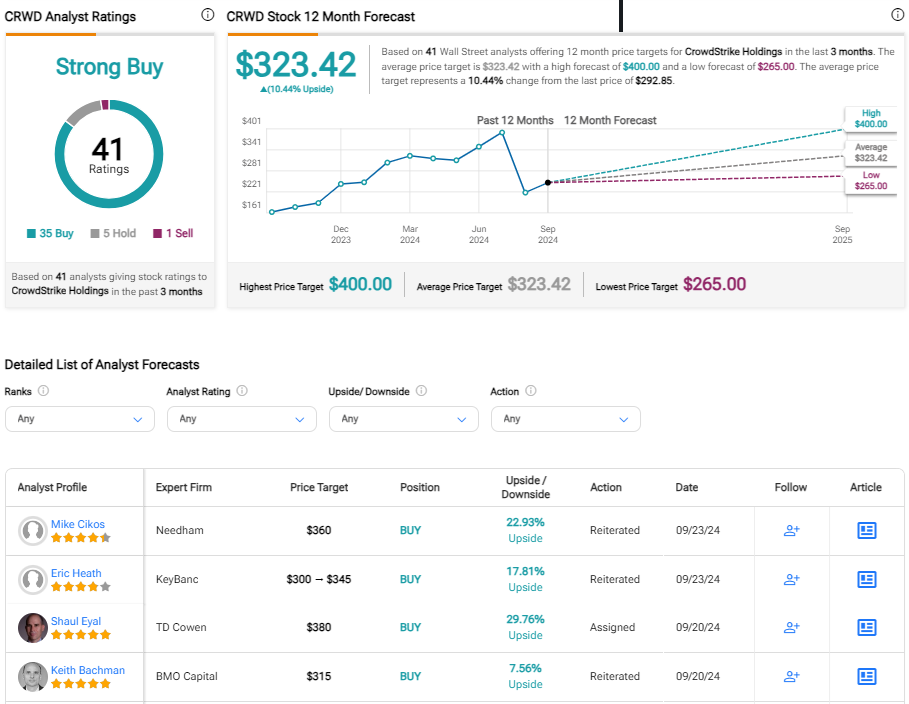

Crowdstrike is rated as a Strong Buy among 41 analysts with a projected 10% upside from current levels. The stock has 35 buy ratings, five Hold ratings, and one Sell rating. The average price target for CRWD is $323.42, or about 8% higher than its recent trading price. The highest price target of $420 implies a 42% upside potential.

The Bottom Line on Crowdstrike Stock

Crowdstrike endured a sharp decline after the global IT outage, which was overdone. Investors realized this and rushed to accumulate shares leading up to the earnings report. Luckily for investors, the cybersecurity firm demonstrated its resilience and posted strong results.

Despite the rally, the stock still remains in a sharp correction. Rising profit margins and cybersecurity tailwinds are some of the catalysts that can propel the stock to an all-time high, rewarding patient investors in the process.

Questions or Comments about the article? Write to editor@tipranks.com