Criteo SA (CRTO) has acquired retail media technology company Mabaya for an undisclosed amount. Criteo is an advertising company that provides online display advertisements.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the announcement, shares of the company increased almost 3% to close at $37.01 on May 20.

The addition of Mabaya’s technology will complement Criteo’s leading Retail Media solutions. This, in turn, will help online marketplace sellers and brands to increase their product sales through better advertisements on e-commerce websites and apps.

Furthermore, the move will augment Criteo’s ability to help traditional retailers to develop their own online marketplace businesses.

Criteo’s Growth Portfolio EVP and General Manager Geoffroy Martin said, “Marketplaces serve an essential function of helping consumers discover and purchase the widest assortment of products. Supporting this rapidly growing market segment is a tremendous growth opportunity for Criteo. With the addition of Mabaya’s technology to our solutions, no company is better positioned than Criteo to address the massive retail media market opportunity.” (See Criteo SA stock analysis on TipRanks)

On May 5, Criteo reported strong Q1 results. The company’s total revenues of $213 million surpassed the Street’s estimates of $201.1 million and grew 4% from the year-ago period. Also, earnings soared 29% to $0.67 per share, beating the consensus estimate of $0.51 per share.

Following the Q1 earnings, Rosenblatt Securities analyst Mark Zgutowicz increased the stock’s price target to $45.00 from $35.00 for a 21.6% upside potential and reiterated a Buy rating.

Zgutowicz said, “While acknowledging retargeting headwinds for the foreseeable future, we continue to like CRTO shares for its non-retargeting revenue momentum, and subsequent increasing concentration of company revenue. We project Criteo’s non-retargeting segment, New Solutions, to reach ~40% of total ‘22E revenue, valuing the shares today at a reasonable ~5x ’22-23E New Solutions revenue alone.”

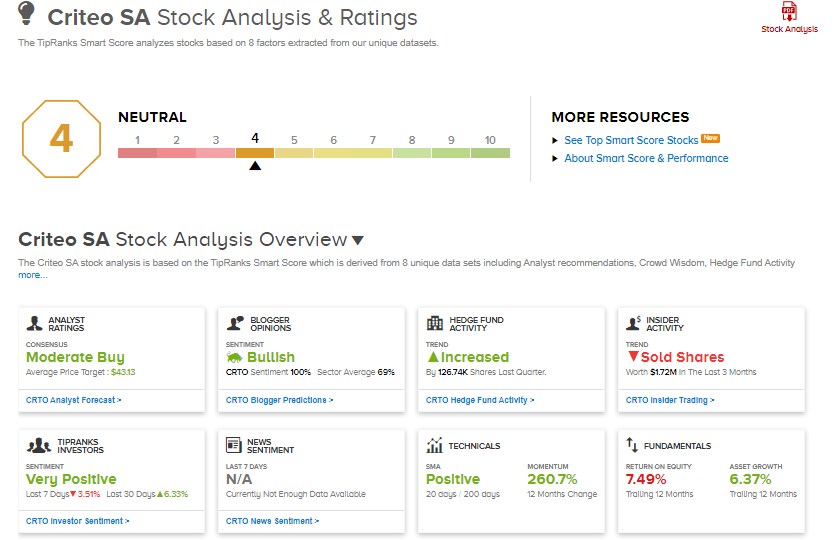

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 4 Buys and 4 Holds. The average analyst price target of 43.13 implies 16.5% upside potential to current levels. Shares have increased almost 99% over the past six months.

Criteo scores a 4 of 10 from TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market averages.

Related News :

Target Posts Blowout First Quarter; Shares Pop

Keysight Technologies Beats Analyst Expectations in Q2

Analog Devices Delivers Strong Q2 Results; Shares Pop 5%