Shares of Alimentation Couche-Tard (ATD.B) fell 5% in early trading Wednesday after the Canadian convenience store chain reported lower profits in its second quarter despite higher revenues. (See Analysts’ Top Stocks on TipRanks)

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Revenue & Earnings

Total revenue came in at $14.22 billion in the quarter ended October 10, an increase of 33.5% from $10.66 billion a year earlier. Analysts on average expected revenue of $14 billion.

Total revenue from merchandise and services was $4 billion, an increase of 5.8%. Same-store merchandise revenues decreased 2.1% in Canada, while they increased 1.4% in the United States and 3.9% in Europe and other regions.

Net earnings amounted to $694.8 million ($0.65 per diluted share) for Q2 2022 compared with $757 million ($0.68 per diluted share) for Q2 2021.

Adjusted net earnings were approximately $693 million, compared with $735 million in the prior-year quarter. Adjusted diluted net earnings per share were $0.65, a decrease of 1.5% from $0.66 last year. Analysts were expecting $0.66 per share.

Management Commentary

Couche-Tard president and CEO Brian Hannasch said, “I am pleased to report that across our global network, we had solid results during the second quarter in both convenience and fuel. Same-store sales were particularly notable in our U.S. and European markets as we continue to see growing momentum with our food program. Fuel volumes showed an upward trend in Europe, while other geographies remained impacted by COVID-19 traffic patterns.

“Across the board, we continue to achieve healthy fuel margins. I am particularly proud of the work we did this quarter to improve the customer experience and drive traffic to our stores from enhancing Sip & Save, our beverage subscription offer, to introducing frictionless checkout in our Arizona stores and pioneering a global partnership bringing our stores to life in a leading augmented reality mobile game.”

Dividend Hike

Couche-Tard CFO Claude Tessier said that the company’s financial position is strong, highlighted by a leverage ratio of 1.23, resulted in the announcement of a 25.7% increase of the quarterly dividend, from C$0.0875 to C$0.11. The payment will be effective December 16, 2021, for shareholders on record as of December 2, 2021.

Wall Street’s Take

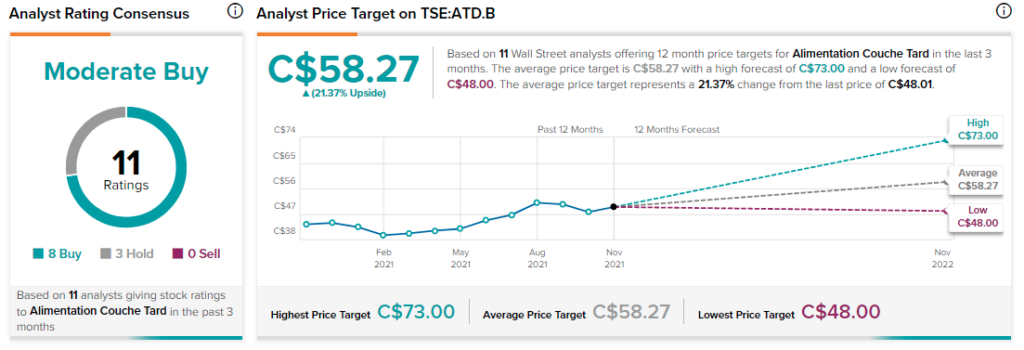

Following the results, RBC Capital analyst Irene Nattel kept a Buy rating on ATD.B with a C$73 price target. This implies 51.8% upside potential.

Consensus among analysts is that ATD.B is a Moderate Buy based on eight Buys and three Holds. The average Alimentation Couche-Tard price target of C$58.27 implies 21.4% upside potential to current levels.

Related News:

High Liner Q3 Profit More than Doubles

Loblaw’s Profit Rises 26% in Q3

Canadian Tire Q3 Profit Falls, Dividend Raised