Shares of Couchbase, Inc. (NASDAQ:BASE) declined 2.6% in Tuesday’s extended trading session after the company reported an adjusted net loss of $0.29 per share for the third quarter of Fiscal Year 2022. The company provides modern databases for enterprise applications.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The figure, however, compares favorably with the net loss of $1.84 per share reported in last year’s quarter. The Street had estimated a loss of $0.35 per share. (See Couchbase stock price charts)

Revenue during the quarter rose 20.2% year-over-year to $30.8 million. Also, it beat the consensus estimate of $30.6 million. The upside can be attributed to the growth witnessed in subscription and services revenues.

Annual recurring revenue (ARR) jumped 21% year-over-over to $122.3 million. Also, the remaining performance obligations as of October 31, 2021, stood at $124.3 million, up 41% year-over-year.

The President and CEO of Couchbase, Matt Cain, said, “We continue to see demand for our modern database as digital transformation remains a priority across industries, and are excited about the market opportunity for Capella which makes it faster and easier to consume Couchbase in the cloud.”

Guidance

The company expects to report revenue in the range of $122.4 million to $122.6 million in Fiscal Year 2022. It anticipates ARR in the range of $129 million to $130 million.

Revenue in the fourth quarter is expected to lie between $33.9 million and $34.1 million. Also, ARR is expected in the range of $129 million to $130 million.

See Insiders’ Hot Stocks on TipRanks >>

Wall Street’s Take

Overall, the stock has a Strong Buy consensus rating based on 5 Buys and 1 Hold. The average Couchbase price target of $45.3 implies upside potential of about 53.4% from current levels.

Positive Sentiments

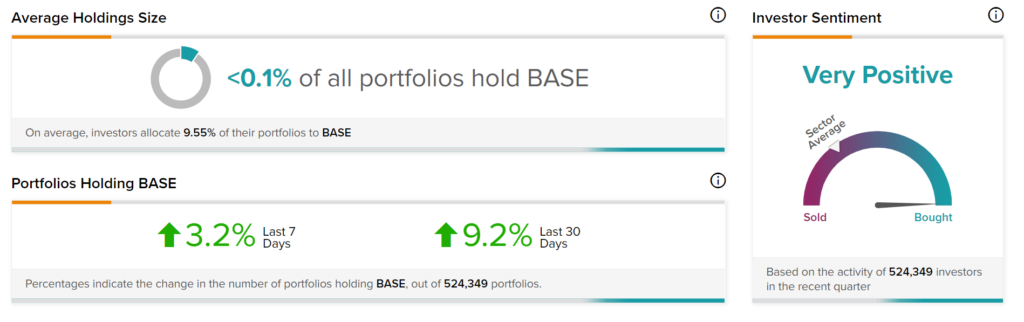

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Couchbase, with 9.2% of investors increasing their exposure to BASE stock over the past 30 days.

Related News:

Cognizant to Bolster Customer Software Solution with Devbridge Buyout

Raytheon Reveals Plan to Repurchase $6B Common Stock

Equinix to Build Presence in Africa with MainOne Acquisition