Costco Wholesale reported double-digit sales growth for November but that number lagged analysts’ expectations and also indicated a slowdown compared to October.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Costco’s (COST) net sales grew 15.1% year-over-year to $15.7 billion in November, with comparable sales growth of 13.4%, which lagged analysts’ estimate of 13.8%. Moreover, comparable sales slowed down compared to a growth rate of 14.4% in October.

Also, the company’s e-commerce comps grew 71.3% in November, reflecting a deceleration from the 91.1% growth rate in October. Coming to region-wise performance, Costco’s US comps grew 12%, while comps in Canada and Other International markets increased at a higher rate of 16.4% and 18.2%, respectively, in November.

Overall, Costco’s net sales for the fiscal first quarter (ended Nov. 22) grew 16.9% year-over-year to $42.4 billion. Costco and peers like Walmart have been seeing strong growth trends since the pandemic with people spending more time at home. However, growth trends have moderated after the lockdown-induced stockpiling subsided. (See COST stock analysis on TipRanks)

Following the print, Oppenheimer analyst Rupesh Parikh noted that Costco’s US comps trends softened in November but continue to suggest significant share gains. In a note to investors, Parikh stated, “The hardlines category slowed to a mid-teens comp increase vs. a mid-20’s rate in Sept. and Oct. The softer growth appears to be driven by the consumer electronics category, which has experienced very robust growth since May. As a result, we believe the slowdown could have been impacted by a pull-forward in demand. US traffic remained robust increasing 8.4%.”

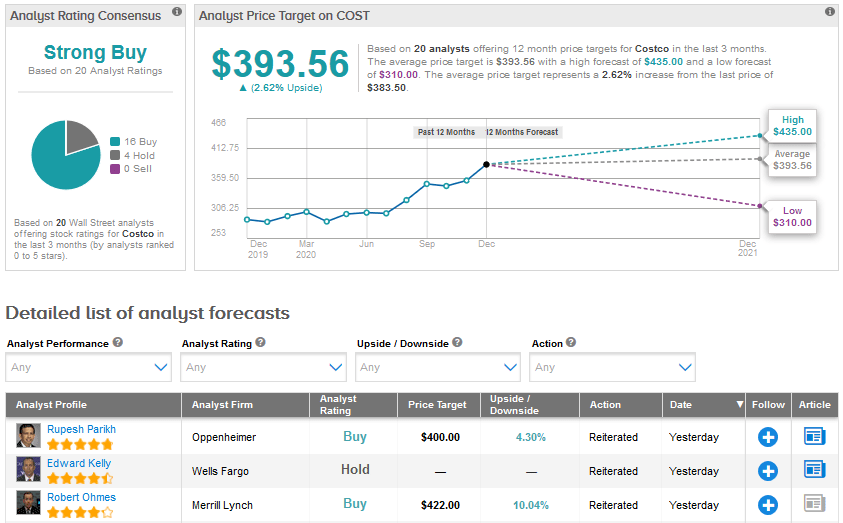

Parikh reiterated a Buy rating with a $400 price target and stated that Costco remains a top pick.

With shares up about 34% year-to-date, the average price target of $393.56 indicates a moderate upside potential of 2.6% in the coming months. Overall, 16 Buys and 4 Holds add up to a Strong Buy analyst consensus.

Related News:

J.M. Smucker Lowers FY21 Outlook After Crisco Sale

Kohl’s To Host Sephora Beauty Shops; Shares Pop 13%

Amazon To Pay $500M In Holiday Bonuses; Street Is Bullish