Costco Wholesale Corp. saw comparable sales growth of 11.1% year-on-year in March for the five weeks that ended on April 4, excluding gasoline prices and exchange rate fluctuations. Comparable sales growth for thirty-one weeks ending on April 4 was 13.9%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

However, Costco’s (COST) e-commerce platforms saw a comparable sales jump of 54.5% and 75.9% for five and thirty-one weeks, respectively.

The company saw a rise in sales of 17.6% year-on-year to $18.21 billion in the month of March for the five weeks that ended on April 4. For the thirty-one weeks that ended on April 4, Costco had sales of $111.4 billion, up by 15.7% year-on-year.

In fiscal 2Q, Costco reported 2Q earnings of $2.14 per share, which grew 1.9% year-over-year but fell short of the Street’s estimates of $2.45 per share. 2Q earnings included “$246 million pretax, or $0.41 per diluted share, in costs incurred primarily from COVID-19 premium wages,” the company said. (See Costco Wholesale Corp. stock analysis on TipRanks)

Following the March sales results, Oppenheimer analyst Rupesh Parikh raised the price target from $370 to $400 and assigned a Buy rating on the stock. Parikh said, “Two-year global comp trends remained steady at an adjusted 25.2% in March vs. 24.0% in February. US-stacked comp trends also accelerated to an adjusted +25.4% in March from +21.9% in February. We suspect US trends, similar to others, likely benefited somewhat from recent government stimulus, but it is difficult to quantify precisely.”

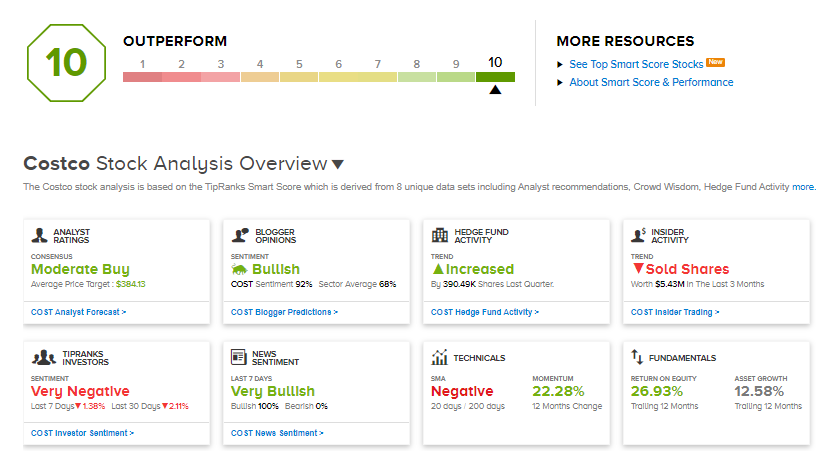

Overall, the rest of the Street has a bullish outlook on the stock, with a Strong Buy consensus rating based on 14 Buys and 4 Holds. The average analyst price target of $384.13 implies upside potential of approximately 7% to current levels. Shares have gained about 9.2% over the past month.

Furthermore, COST scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Best Buy Launches $200 Per Year Membership Program

Okta Reaffirms Financial Outlook, Launches New Products On Investor Day

Shell Expects To Take A $200M Hit From Texas Winter Storm