Costco Wholesale Corp. said late Wednesday that October net sales surged 15.9% to $13.82 billion year-over-year. The membership-only warehouse club chain operator’s strong sales were boosted by stellar growth in e-commerce orders.

Costco (COST) reported that its comparable sales soared 14.4% in the four weeks ended Nov. 1, reflecting strong growth in North America as well as other international markets. E-commerce sales spiked 91.1%. Excluding impacts of foreign currency exchange rates and changes in gasoline prices, comparable sales grew 16.5%.

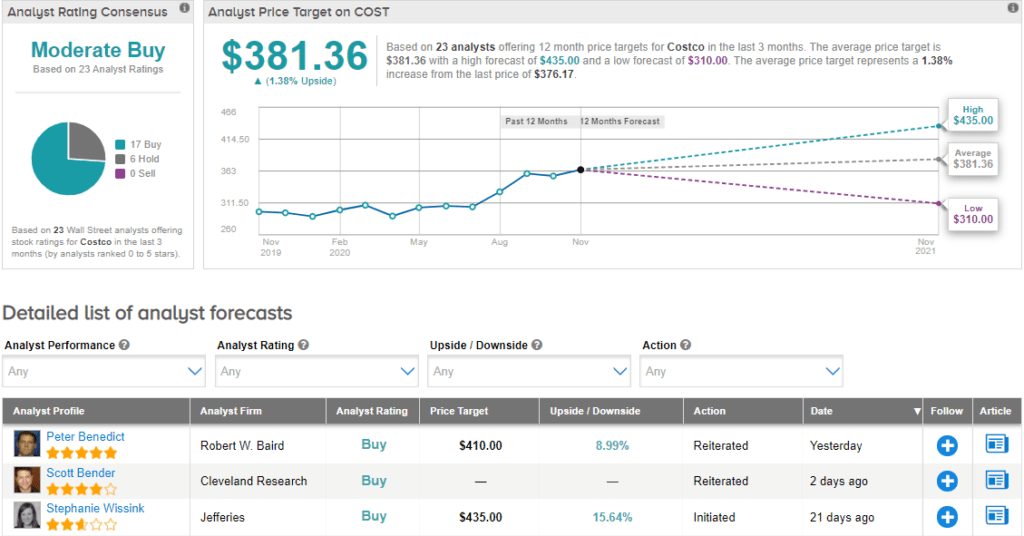

Following the company’s October sales data release, Robert W. Baird analyst Peter Benedict raised the stock’s price target to $410 (9% upside potential) from $375 and reiterated a Buy rating. In a note to investors, Benedict said that he didn’t notice a “slowdown” at Costco and is encouraged by a continuous recovery in traffic. The analyst believes that the company could be among the “strongest” top-line performers in the retail space given its strength across regions, categories and channels. (See COST stock analysis on TipRanks).

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 17 Buys and 6 Holds. With shares up 28% on a year-to-date basis, the average price target of $381.36 implies a moderate upside potential of about 1.4% to current levels.

Related News:

Hilton Surprises With Quarterly Profit As Demand Steps Up; Shares Gain

Expedia Gains 6% Despite Third Consecutive Loss

Wendy’s Drops 4% In Pre-Market As Quarterly Sales Disappoint