Shares in Novavax (NVAX) are currently jumping 42% in pre-market trading after the biotech company said that it has been granted $1.6 billion by the U.S. government to fund the development of a potential coronavirus vaccine.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The stock is soaring to $116.53 in Tuesday’s pre-market trading as Novavax announced that it has been selected to participate in Operation Warp Speed (OWS), a U.S. government program that seeks to begin supplying millions of doses of a safe, effective vaccine for COVID-19 in 2021. As part of the program, Novavax has been awarded with the funding to complete its late-stage clinical development, including a pivotal Phase 3 clinical trial of its COVID-19 candidate NVX‑CoV2373 and supply 100 million doses of the vaccine as early as late 2020.

“The pandemic has caused an unprecedented public health crisis. We are honored to partner with Operation Warp Speed to move our vaccine candidate forward with extraordinary urgency in the quest to provide vital protection to our nation’s population,” said Novavax CEO Stanley C. Erck. “We are grateful to the U.S. government for its confidence in our technology platform, and are working tirelessly to develop and produce a vaccine for this global health crisis.”

NVX‑CoV2373 consists of a stable, prefusion protein made using its proprietary nanoparticle technology and includes Novavax’ proprietary Matrix‑M adjuvant. In May, Novavax initiated a Phase 1/2 clinical trial of NVX-CoV2373 in 130 healthy participants 18 to 59 years of age began in Australia. Preliminary immunogenicity and safety results from the trial are expected at the end of July, and the Phase 2 portion to assess immunity, safety, and COVID-19 disease reduction is expected to begin thereafter. The Phase 1/2 clinical trial is being supported by an up-to $388 million funding arrangement with the Coalition for Epidemic Preparedness Innovations (CEPI).

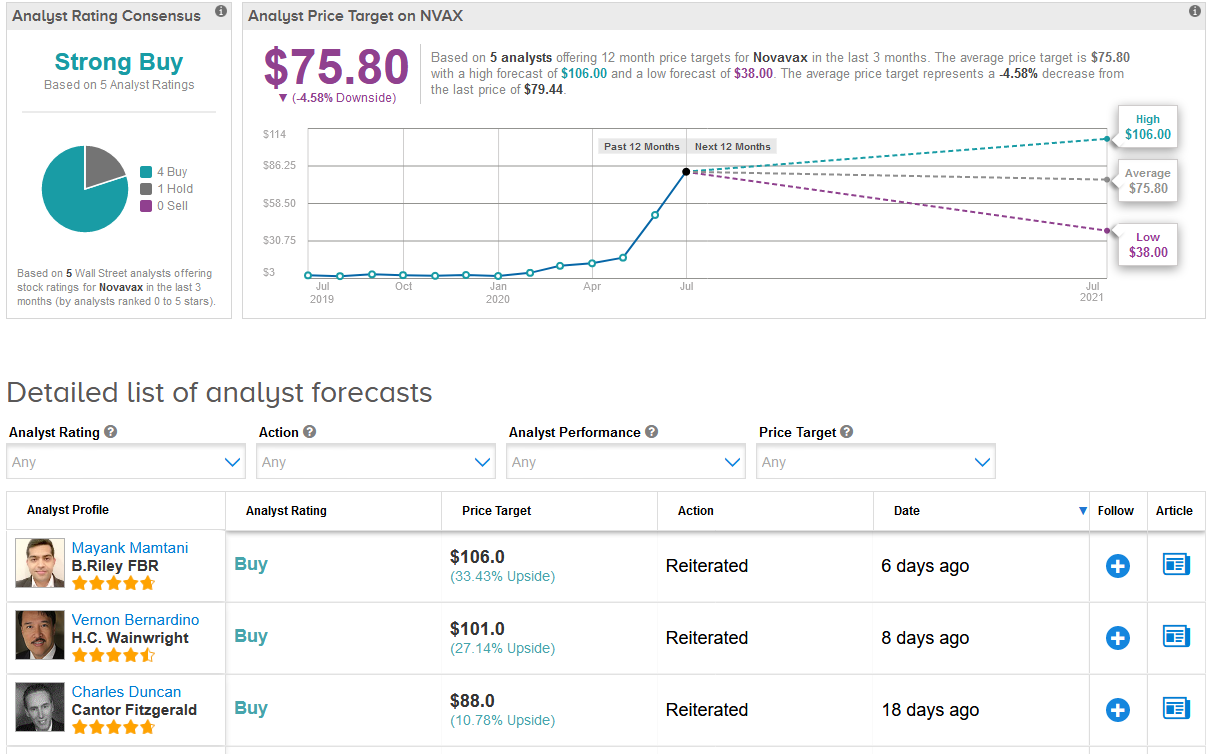

In the run-up to developing a coronavirus vaccine, the stock has this year gone up almost 20 times in value. However, shares dropped 5% this month, prompting B. Riley FBR analyst Mayank Mamtani to recommend investors take advantage of the stock weakness.

At the same time, Mamtani reiterated his Buy rating on the stock with a $106 price target, suggesting that despite this year’s rally shares are poised to gain another 33% over the coming 12 months.

The rest of the Street shares Mamtani’s outlook. The Strong Buy analyst consensus is backed up by 4 Buy ratings versus 1 Hold rating. Meanwhile, the $75.80 average price target indicates 4.6% downside potential from current levels. (See Novavax stock analysis on TipRanks).

Related News:

Cellectis Sinks 13% In Extended Trading After FDA Halts Cancer Clinical Trial

Chembio Gains 12% After-Hours On New Covid-19 BARDA Contract

Gilead’s Covid-19 Remdesivir Therapy Gets Conditional European Nod