Novavax (NVAX) on Wednesday announced the acquisition of Praha Vaccines to help the late-stage biotech company produce over 1 billion doses of its experimental Covid-19 vaccine candidate starting in 2021.

The U.S. company will buy the manufacturing plant for about $167 million in an all cash transaction. Starting in 2021, the plant is expected to provide an annual capacity of over 1 billion doses of antigen for the company’s vaccine candidate, also known as NVX‑CoV2373. As part of the transaction, about 150 employees with experience in vaccine manufacturing and support will join Novavax.

“Manufacturing capacity is a critical component of our strategy to deliver a vaccine for the COVID-19 pandemic,” said Stanley C. Erck, President and CEO of Novavax. “This acquisition provides the vital assets required to produce more than 1 billion doses per year. We will continue efforts to expand antigen capacity in the U.S. and Asia, and increase production of Matrix-M to match antigen capacity at multiple sites globally.”

NVX‑CoV2373 consists of a stable, prefusion protein antigen made using Novavax’s proprietary nanoparticle technology and includes its proprietary Matrix‑M adjuvant. On Tuesday, Novavax announced that it is starting human testing in its Phase 1/2 clinical trial of the vaccine candidate and is expecting results in July.

The Praha Vaccines acquisition is supported by a funding arrangement with the Coalition for Epidemic Preparedness Innovations (CEPI), which will help the company to expand its manufacturing capacity.

As part of the deal, the biotech company will work in collaboration with the Serum Institute of India (SII) to boost production levels at the Bohumil facility by the end of 2020.

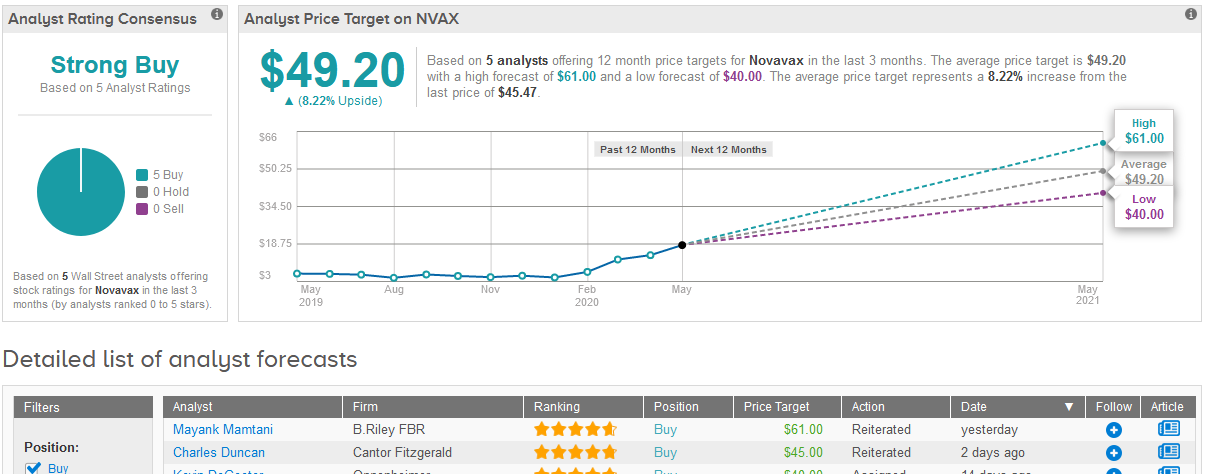

Novavax’s stock has jumped 10 times in value since the start of the year and was down 5.6% trading at $45.47 as of Wednesday’s close.

Following the announcement, five-star analyst Mayank Mamtani at B. Riley FBR raised the stock’s price target to $61 from $53, reflecting another 34% upside potential in the shares over the coming year.

Mamtani said that he now expects earlier global market entry of the 2373 vaccine candidate as well as “model additional non-dilutive funding to further accelerate development and commercialization activities.” The analyst maintained a Buy rating on the stock.

“We view this as another encouraging development providing validation to the de-risked nature of NVAX’s vaccine candidate, on the basis of the most extensive/differentiated preclinical data generated to date, and now reviewed closely by global scientific community residing with CEPI, WHO, and SII as well as U.S. agencies such as CDC, NIH-NIAID, and BARDA,” Mamtani wrote in a note to investors.

The rest of Wall Street analysts covering the stock in the past three months join Mamtani in their recommendation to Buy the shares. The Strong Buy consensus is backed up by 5 unanimous Buy ratings. In view of the stock’s fast rally this year, the $49.20 average price target indicates a modest 8% upside potential in the coming 12 months. (See Novavax stock analysis on TipRanks).

Related News:

Novavax Begins Human Testing For Covid-19 Vaccine, Expects Results In July

Novavax Spikes 31% on $384 Million Cash Injection for Vaccine Production

Novavax Seeks To Raise $250 Million From Share Sale; Top Analyst Bumps Up PT