After several delays and setbacks, Novavax (NVAX) finally filed an EUA request for its Covid-19 vaccine with the FDA at the end of January. Given precedents and the company’s recent comments, Jefferies’ Roger Song thinks a decision is due shortly.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

“We see the decision as a near-term stock-moving catalyst, and high likelihood of positive outcome, providing upside potential to the current share price,” Song opined.

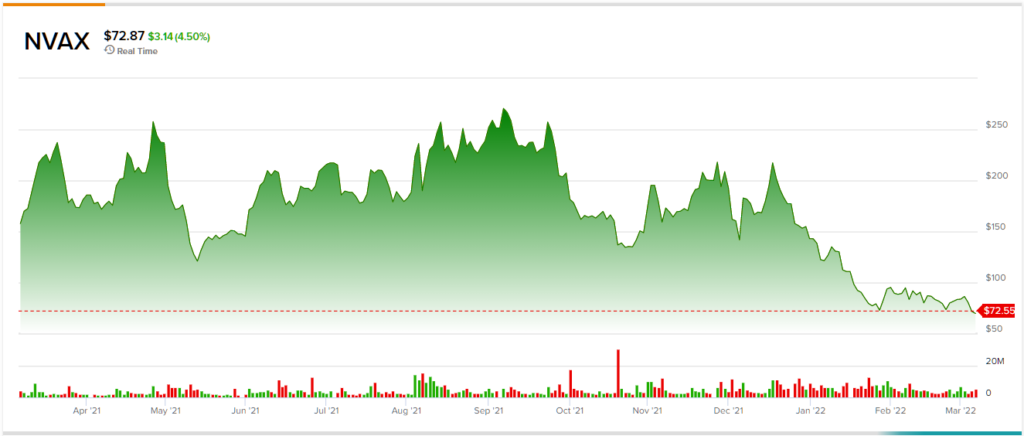

That could come in handy right now. Like most of the market, the stock has retreated significantly in recent times, showing losses of 50% year-to-date.

Although Song notes US approval most probably won’t “materially impact” near-term sales, it “meaningfully affects the long-term revenue opportunity.”

Song sees the vaccine maker’s sales guidance for 2022 of $4-5 billion as “achievable,” and believes that based on the company’s comments, US sales “represents the upside” from the 2022 guidance.

There are other reasons why approval could act as a near-term catalyst. An EUA suggests that in the US there is still “urgent need” for another Covid-19 vaccine. Additionally, the approval could have a knock-on effect and will result in filings of a BLA (biologics license application), and for booster and pediatric indications; all highlight the potential for long-term revenue generation.

In fact, while the company awaits the EUA decision, it is readying the BLA to gain full approval in 2H22. This could provide a “second shot on goal.”

Given the results from the late-stage studies were generally just as good as those from the already fully approved vaccines, Song sees a “very high likelihood of approval given the robustness of the data package.”

So, potentially good news will be heading Novavax’ way, but what does it all mean for investors? Song reiterated a Buy rating, backed by a $198 price target. Should the figure be met, investors will be sitting on returns of a hefty 173%. (To watch Song’s track record, click here)

Turning now to the rest of the Street, other analysts are generally on the same page. 5 Buys and 1 Hold add up to a Strong Buy analyst consensus. The average target is only slightly lower than Song’s objective; at $196, the figure suggests shares will climb ~169% higher over the coming months. (See Novavax stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.