Johnson & Johnson said that it has kicked off a Phase 3 clinical trial in the UK to test a two-dose regimen of its vaccine candidate for the prevention of COVID-19.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

J&J (JNJ) disclosed that Ensemble 2 is a complementary, pivotal, large-scale, multi-country Phase 3 trial that will study the safety and efficacy of a two-dose regimen of the vaccine candidate. The two-dose regimen will run in parallel to the Phase 3 study of the single-dose regimen of JNJ-78436735 and will be tested in up to 30,000 participants worldwide.

The Phase 3 trials follow positive interim results from J&J’s ongoing Phase 1/2a clinical trial, which is studying the safety profile and immunogenicity of both a single-dose and two-dose vaccination. The interim analysis showed that a single dose of the COVID-19 vaccine candidate induced a robust immune response and was generally well-tolerated.

In a separate statement, J&J announced the expansion of an agreement with the US Department of Health and Human Services to support the next phase in the research and development of its investigational COVID-19 vaccine candidate.

Under the agreed terms, the US drugmaker will commit about $604 million and the US government will commit about $454 million to fund the ongoing Phase 3 trial evaluating its COVID-19 candidate as a single-dose vaccination in up to 60,000 volunteers worldwide.

“We greatly value the ongoing confidence and support of our investigational COVID-19 vaccine candidate development program,” said J&J’s Chief Scientific Officer Paul Stoffels. “Combined with our own significant investment, this agreement has enabled our vital research and development and underscores the importance of public-private partnerships to tackle the worldwide COVID-19 pandemic.”

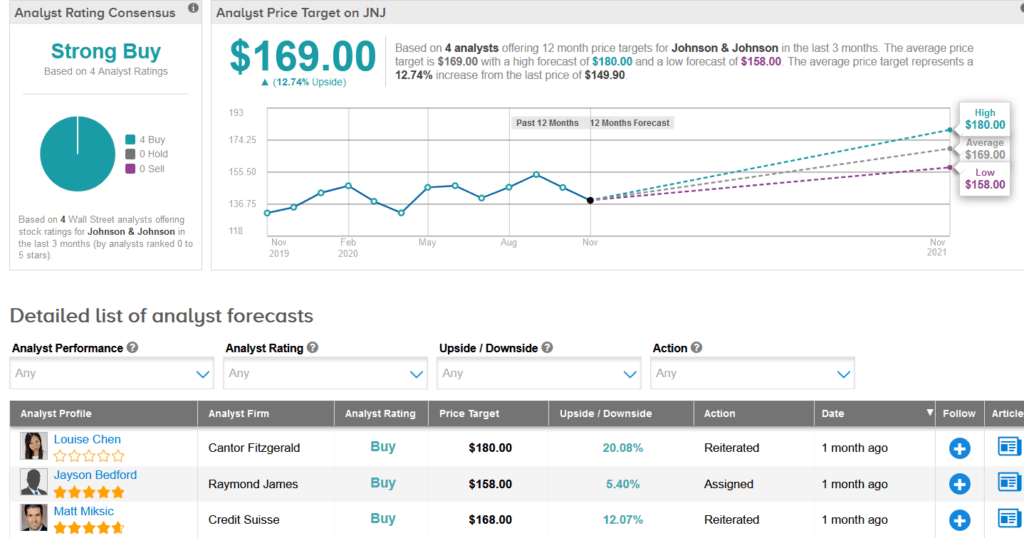

Shares of JNJ are up more than 5% over the past five days, taking their year-to-date advance to about 3%, and the stock scores a bullish Strong Buy Street consensus. That’s with 4 back-to-back Buy ratings over the last three months. Meanwhile, the average analyst price target of $169 indicates 13% upside potential lies ahead.

Last month, Cantor Fitzgerald analyst Louise Chen raised the stock’s price target to $180 (21% upside potential) from $168 and maintained a Buy rating, saying that J&J’s recent Q3 EPS and sales beat, reflect solid performance and positive trends across its diversified business model. (See JNJ stock analysis on TipRanks)

Related News:

Pfizer, BioNTech Announce COVID-19 Vaccine is 90% Effective

Ocular Therapeutix Rises 7% On Stellar Results Backed By Dextenza

Canada’s Canopy Growth Pops 12% On Blowout Quarter, Cost Cuts