India’s drug regulator granted Cipla Ltd. and Hetero Labs the approval to produce and sell a generic version of Gilead Sciences Inc.’s (GILD) coronavirus drug candidate remdesivir.

The two Indian drugmakers have been granted regulatory approval by the Drug Controller General of India (DCGI) for restricted emergency use in the country. Hetero’s generic version of remdesivir will be marketed under the brand name Covifor in India, while Cipla’s generic version of remedisvir will be called Cipremi.

“In the light of increasing COVID-19 cases in India, the approval of Covifor (remdesivir) can prove to be a game-changer given its positive clinical outcomes,” Hetero chairman Dr. B. Partha Saradhi Reddy said in a statement. “Backed by strong backward integration capabilities, we can ensure that the product is immediately made available to patients across the country. We are prepared for ensuring enough stocks required to cater to the present needs.”

Remdesivir has been granted approval by DCGI for the treatment of suspected or laboratory-confirmed cases of COVID-19 in adults and children, hospitalized with severe symptoms of the disease. Covifor will be available in 100 milligram doses which will be administered intravenously in a hospital setting.

Remdesivir is a viral RNA polymerase inhibitor which means that it interferes with the production of viral genetic material, preventing the virus from multiplying. Gilead’s investigational antiviral therapy has received Emergency Use Authorization (EUA) by the U.S. Food and Drug Administration (FDA) to treat COVID-19.

Shares in Gilead rose 4.6% to $77.47 on Friday taking the year-to-date advance to 19%.

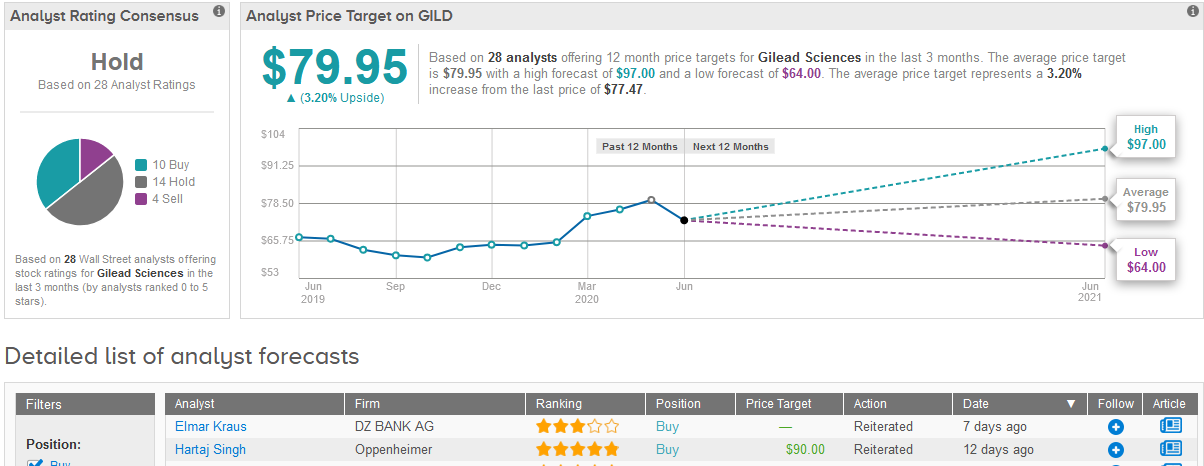

Five-star analyst Hartaj Singh at Oppenheimer this month reiterated a Buy rating on the stock with a $90 price target, saying that investors are ascribing little value to Gilead’s quality emerging pipeline, and that any sustained weakness into 2Q20 should be viewed as a buying opportunity.

Singh added that Gilead’s $1 billion investment in remdesivir manufacturing, R&D and sales and marketing efforts are potentially not reflected in 2Q/3Q20 consensus earnings estimates, which could potentially lead to earnings misses.

For now though, the majority of Wall Street analysts remain sidelined on the stock. The Hold consensus is based on 14 Hold ratings and 4 Sell ratings versus 10 Buy ratings. The $79.95 average price target implies a mere 3% upside potential in the shares in the coming 12 months. (See Gilead stock analysis on TipRanks)

Related News:

Oxford Biomedica Clinches Manufacturing Deal For AstraZeneca’s Covid-19 Vaccine

5 Promising Covid-19 Vaccines Picked For Trump’s Operation Warp Speed

What Would a Merger Mean for Gilead? Top Analyst Weighs In