Gilead Sciences Inc. (GILD) on Monday priced its experimental coronavirus drug candidate remdesivir at $2,340 per patient for a 5-day treatment in the U.S. and other developed countries.

The price for governments of developed countries is $390 per vial based on the assumption that patients are expected to receive a 5-day treatment course using 6 vials of remdesivir. In the U.S., the same government price of $390 per vial will apply. The price for U.S. private insurance companies will be $520 per vial.

“We discounted the price to a level that is affordable for developed countries with the lowest purchasing power… to remove the need for country by country negotiations on price,” Gilead chairman and CEO Daniel O’Day said in an open letter. “At the current price of $390 per vial, remdesivir is positioned to achieve the aim of providing immediate net savings for healthcare systems.”

O’Day added that remdesivir’s pricing has been a “topic that has attracted more speculation than any other” since U.S. regulators approved its emergency use in some COVID-19 patients in May.

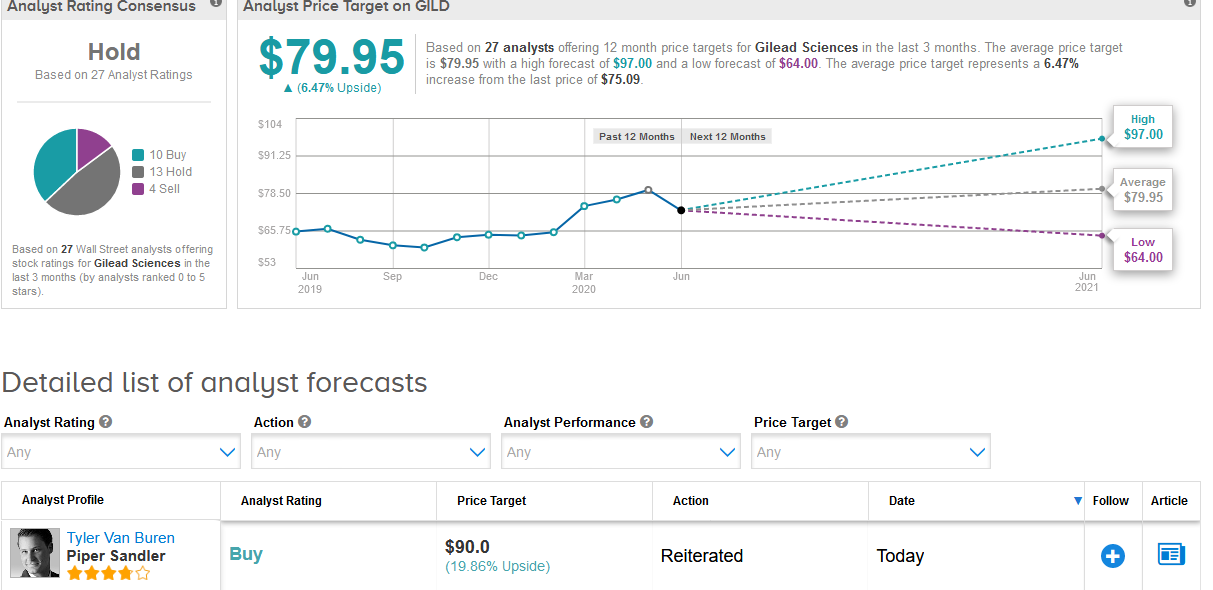

Piper Sandler analyst Tyler Van Buren said that the remdesivir pricing for developed countries, is “perfectly reasonable” and within expectations considering that the “value of early discharge is $12,000 per the US government”. Van Buren maintained a Buy rating on the stock with a $90 price target (reflecting 19% upside potential).

O’Day said that by the end of this year, investment on the development and manufacturing of remdesivir is expected to exceed $1 billion. The company seeks to to produce more than 2 million treatment courses of its experimental candidate remdesivir by the end of the year and many millions more in 2021, it said last week.

Remdesivir is a viral RNA polymerase inhibitor which means that it interferes with the production of viral genetic material, preventing the virus from multiplying. The investigational antiviral therapy has received Emergency Use Authorization (EUA) by the FDA to treat COVID-19.

Gilead has entered into an agreement with the U.S. Department of Health and Human Services (HHS) so that the HHS and states can manage allocation to hospitals until the end of September. After this period, once supplies are less constrained, HHS will no longer manage allocation, the company said.

In the developing world, where healthcare resources, infrastructure and economics are very different, Gilead has entered into agreements with generic manufacturers to deliver treatment at a substantially lower cost.

Shares in Gilead rose about 1% to $75.24 in late morning U.S. trading boosting the year-to-date advance to about 23%.

For now, Wall Street analysts remain sidelined on the stock. The Hold consensus is based on 13 Hold ratings and 4 Sell ratings versus 10 Buy ratings. The $79.95 average price target implies 6.5% upside potential in the shares in the coming 12 months. (See Gilead stock analysis on TipRanks).

Related News:

AstraZeneca Strikes $127 Million Deal With Brazil For Covid-19 Vaccine

Vaxart Explodes 96%- And Rallies After-Hours- On Covid-19 Deal

LabCorp Launches Neutralizing Antibody Test For Covid-19