ABB announced on Thursday that its robots will be used for Covid-19 testing in Singapore to automate some of the manual steps required in sample processings and to save costs.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

ABB (ABB) said that as part of Singapore’s efforts to boost its nation-wide Covid-19 testing capabilities, the Swiss engineering company’s high-precision robots have been deployed in the city’s new automated laboratory system, known as the Rapid Automated Volume Enhancer (RAVE) testing system.

Two sets of the RAVE system and associated equipment can process an “industry-topping” volume of 4,000 samples a day, the company said. RAVE also reduces test contamination and infection risks for laboratory workers.

ABB has supplied 4 IRB 910 SCARA units, including simulation and programming support, used in the pilot testing cell. RAVE was launched in July 2020, and ABB has since received an order for an additional 14 robot units.

“Together we are increasing Singapore’s testing capacity by automating key laboratory processes, with our robots undertaking a range of repetitive and dangerous tasks to improve laboratory conditions for employees, reducing the risk of contamination and fatigue,” ABB’s Sami Atiya said.

In addition, ABB announced that its collaborative robot, YuMi is being studied and used in a research case application at the Polytechnic University of Milan to support hospitals in serological testing for the coronavirus. Once deployed, YuMi will be able to automate up to 77% of the operations required to perform the tests and analyze up to 450 samples per hour.

ABB, which makes products ranging from factory robots to electric vehicle chargers, has about 110,000 employees in over 100 countries.

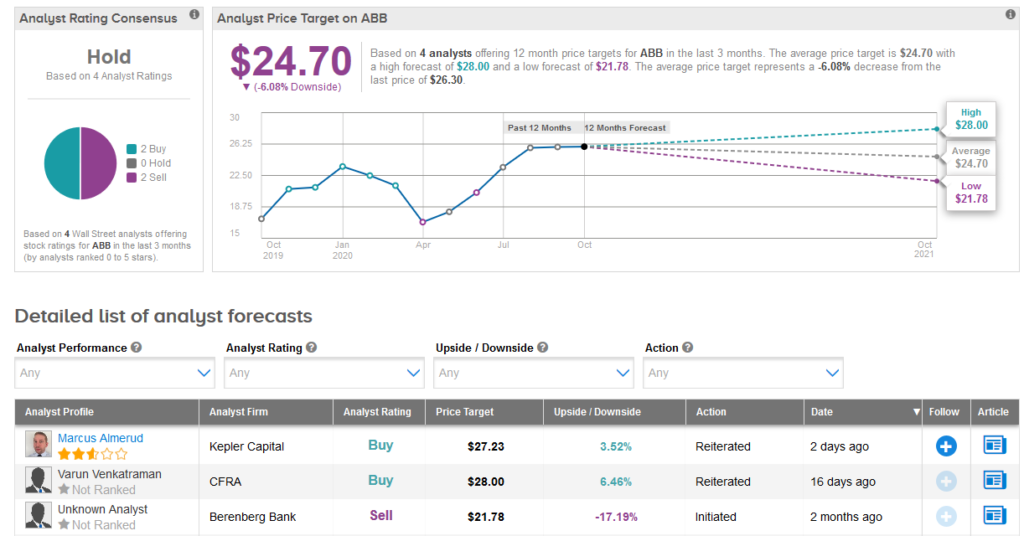

Shares in ABB have advanced 9.2% so far this year, with the $24.70 average analyst price target implying 6.1% downside potential lies ahead.

CFRA analyst Varun Venkatraman last month reiterated a Buy rating on the stock with a $28 price target, calling ABB a leader in the long-term growth market of industrial automation.

Venkatraman noted that ABB’s recent decision to sell its Power Grids business to Hitachi for $6.85 billion puts it in a good position to improve margins and deliver long-term revenue growth for investors.

The analyst believes that cash proceeds from the deal will be used for share buybacks that will boost earnings per share.

Meanwhile, the rest of the Street is sidelined on the stock. The Hold analyst consensus shows 2 Sells versus 2 Buys. (See ABB stock analysis on TipRanks)

Related News:

BioNTech, Rentschler Partner For Covid-19 Vaccine Manufacturing

Gilead Inks EU Supply Deal For 500,000 Remdesivir Doses

Regeneron Files For Emergency Use Nod Of Covid-19 Antibody Cocktail; Shares Rise