Shares of Corning rose 4.1% on Wednesday after the maker of glass and ceramics used in technological equipment provided a stronger-than-expected 3Q revenue outlook.

Corning Incorporated (GLW) projects its 3Q sales to increase in the low-teen percentage range sequentially. Analysts are anticipating the company to report revenues of $2.81 billion, representing quarter-on-quarter growth of 7.3%. The company said that it expects its 3Q profitability growth rate to be faster than its sales growth rate due to cost-cutting measures.

Corning’s CFO Jeff Evenson said, “I’m pleased to share that the positive momentum seen in July has continued, and we expect third-quarter sequential sales growth in the low teens, higher than the current consensus estimate of high-single digits.” (See GLW stock analysis on TipRanks).

On July 28, Susquehanna analyst Mehdi Hosseini raised the stock’s price target to $26 (21.4% downside potential) from $22 and maintained a Hold rating. Hosseini pointed out that improving ASP (average selling price) trends, increasing TV demand in Korea and China, and positive OEM data points as key positive catalysts for Corning.

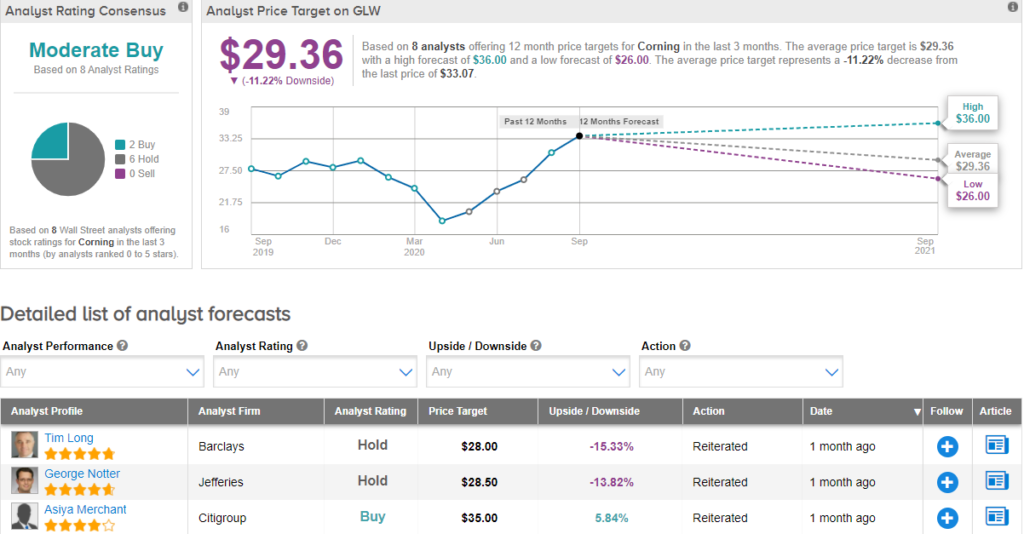

Currently, the Street has a cautiously optimistic outlook on the stock, with a Moderate Buy analyst consensus. With shares up nearly 13.6% year-to-date, the average analyst price target of $29.36 now implies a downside potential of 11.2% from current levels.

Related News:

Slack Tanks 19% In After-Hours As 2Q Billings Miss Estimates

Qorvo Boosts Financial Guidance On Smartphone Upside; Street Bullish

Disney’s Streaming App Downloads Jump 68% On ‘Mulan’ Debut – Report