The steep rally in copper to close to a two-year high of $10,000 per ton may have stalled as buyers resist further hikes. The optimistic investors hoping for a smooth climb to two-year record highs might have to wait longer than expected. Recent developments suggest manufacturers, the drivers of copper’s demand, could be reducing their purchases amidst the current elevated prices.

Copper’s Demand Ceiling

With increased demand fueled by revived global manufacturing, copper prices have been on the rise. The price per pound has gone from $2.41 two years ago to $4.43 today. This is an 83.8% increase for the commodity over that time. However, as Gu Yan, director of copper at Citic Metal Co., points out, “Demand from fabricators is very weak after the recent rally.”

It seems manufacturers, the companies that transform copper into pipes, spools of wire, and other industrial building blocks, are pushing back due to the rising cost. Passing on these price hikes to their customers is proving to be challenging for them. This resistance could potentially cap the demand for copper.

China’s Impact on Copper Prices

China is the world’s undisputed king of copper consumption. Adding to the difficulty for the commodity to rally further is a noticeable hesitancy from China to buy more.

Chinese manufacturers are also drawing a line in the sand, putting a limit on what they will spend on copper. This economic dynamic suggests that a temporary ceiling on demand may have been reached, and this stalls price increases.

A Reality Check for Copper Bulls

Stock market investors who tend to gain exposure to copper through mining companies are learning of the new reality that the bull market may be nearing an end. The three copper producers analyzed below were chosen because they are some of the largest in the industry.

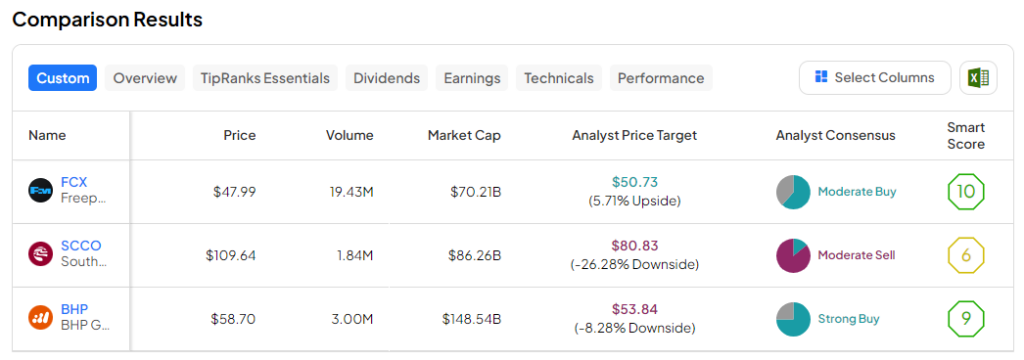

First up is Freeport Mining (NYSE:FCX), a major producer of copper, gold, and molybdenum. Then there is Southern Copper Corporation (NYSE:SCCO), the world’s fourth-largest copper producer, known for its focus on sustainable mining practices. Lastly, there’s BHP Group (NYSE:BHP), a diversified mining company based in Australia. The company extracts copper, iron ore, metallurgical coal, and petroleum from its global operations.

According to the TipRanks Comparison Tool, analysts have mixed reviews of these mining companies.

Key Takeaway

Over the past few years, there has been robust demand for copper, driving prices close to record highs. Copper mining companies are the conduit through which many stock market investors track the movements in copper.

Undoubtedly, investing in mining stocks has been lucrative, but the outlook suggests that future rewards may be more challenging to attain, as copper manufacturers are not as easily agreeing to new price increases.

Questions or Comments about the article? Write to editor@tipranks.com