Copper Mountain Mining (TSE: CMMC), a mining company exploring for gold, silver, and copper deposits, announced Wednesday that it has initiated a zero-cost collar copper price protection program this month.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Contracts Cover 39.6 million Pounds of Copper

Copper Mountain entered into a series of zero-cost collar option contracts, which are for 3.3 million pounds of copper per month through 2022.

In total, they cover 39.6 million pounds of copper. The floor price for monthly copper options has been set at $4 per pound with an average cap price of $4.91 per pound.

CEO Commentary

Copper Mountain president and CEO Gil Clausen said, “We initiated a zero-cost collar copper price protection program this month as we believe it is prudent for us to protect our margins as we invest in our projects this year. This is in line with our strategy to be environmentally and financially judicious, as we move forward with our growth plans. The detailed engineering is progressing well at the Eva Copper Project. We are also continuing to advance the installation of an additional concentrate cleaner flotation cell and another filter press, together with new rougher flotation cell capacity at the Copper Mountain Mine.”

Wall Street’s Take

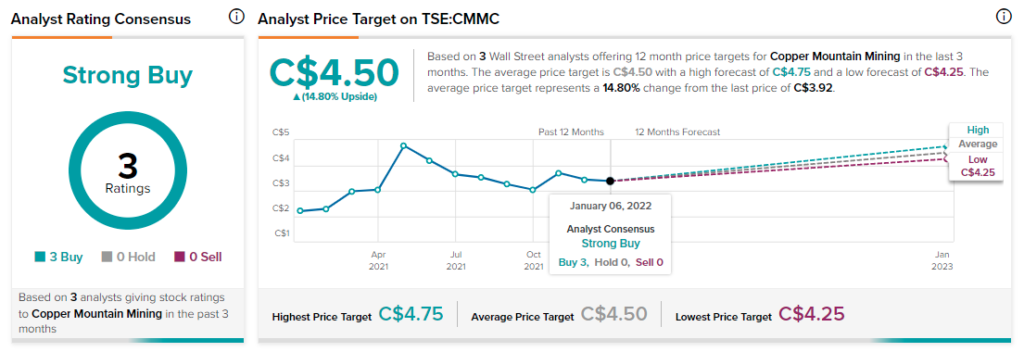

Last month, CIBC analyst Bryce Adams kept a Buy rating on CMMC with a price target of C$4.75. This implies 21.2% upside potential.

Overall, the consensus among Wall Street analysts is that CMMC is a Strong Buy based on three Buys. The average Copper Mountain Mining price target of C$4.50 implies upside potential of about 14.8% to current levels.

Download the TipRanks mobile app now

Related News:

SSR Mining Sells Pitarrilla Project for $127M

GoGold Gives Outlook for 2022