Analysts are highly bullish about Cooper Companies (NASDAQ:COO), an S&P 500 stock (SPX) from the MedTech space. Impressed by Cooper Companies’ Q1 FY24 results, reported on February 29, two analysts upgraded the stock to a Buy from a Hold, while others raised their price targets to indicate optimism about the company’s growth potential.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

California-based Cooper is a global medical device company serving two segments, CooperVision and CooperSurgical. CooperVision has a dominant position in the contact lens market, while CooperSurgical is focused on fertility and women’s health.

Cooper Companies recently undertook a 4-for-1 stock split effective February 16, 2024, with the aim to make its stock more affordable to employees and retail investors. In the past six months, COO stock has gained 12.8%.

Glimpse of Cooper Companies’ Financials

In Q1 FY24, Cooper’s revenue rose 9% year-over-year to $931.6 million, driven by a 7% growth in CooperVision and a 12% jump in CooperSurgical. Meanwhile, adjusted earnings per share (EPS) increased 18% to $0.85, thanks to higher revenue and improved adjusted operating margin.

Based on the solid start to the Fiscal year, Cooper Companies lifted its annual guidance. For FY24, Cooper now projects revenue in the range of $3.847 to $3.897 billion and adjusted EPS between $3.50 and $3.58.

Analysts Optimistic About COO’s Growth Potential

Following the Q1 FY24 print, Redburn Atlantic analyst Issie Kirby upgraded COO stock to Buy from Hold rating, with a price target of $125 (33.7% upside). Kirby is particularly bullish about CooperVision’s growth prospects in 2024, supported by beneficial pricing and mix.

Similarly, Wells Fargo analyst Larry Biegelsen reiterated his Buy view and $110 (17.6% upside) price target on COO stock. Biegelsen is encouraged by management’s expectation of generating double-digit sales growth in the contact lenses segment and a focus on improving the company’s profit margins.

Furthermore, Citi analyst Joanne Wuensch lifted the price target on COO stock to $116 from $108 and maintained a Buy rating as part of her MedTech group review. The five-star analyst has medium-to-high expectations on deliveries, backed by new product launches and pent-up demand. Wuensch is highly optimistic about the sector’s growth prospects in 2024, as companies move ahead from tough year-over-year comparisons on the heels of product launches.

Is Cooper Companies a Buy?

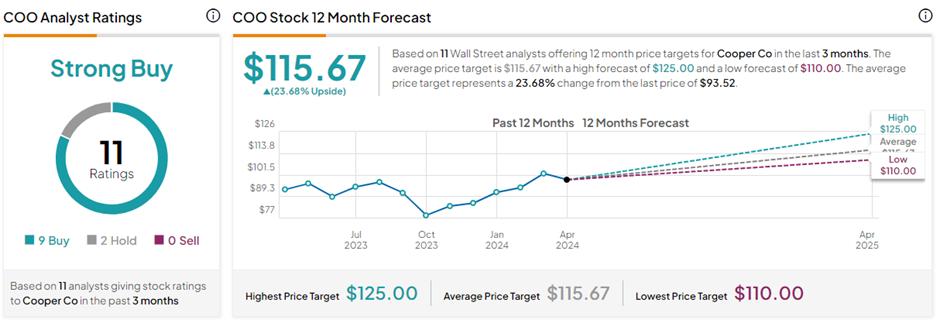

With nine Buys versus two Hold ratings, COO stock commands a Strong Buy consensus rating on TipRanks. The average Cooper Companies price target of $115.67 implies 23.7% upside potential from current levels.

Ending Thoughts

Cooper Companies has a promising future, backed by solid fundamentals, a growing revenue base, and pent-up demand. Analysts favor this stock as they see high long-term growth in the MedTech space.